Other services related to transfers

Transfer cancellation

1. In the Internet Bank select Payments → Payment List. Find the payment that you wish to cancel:

a) If the payment is not marked as Executed, select the payment and click Reject/delete selected.

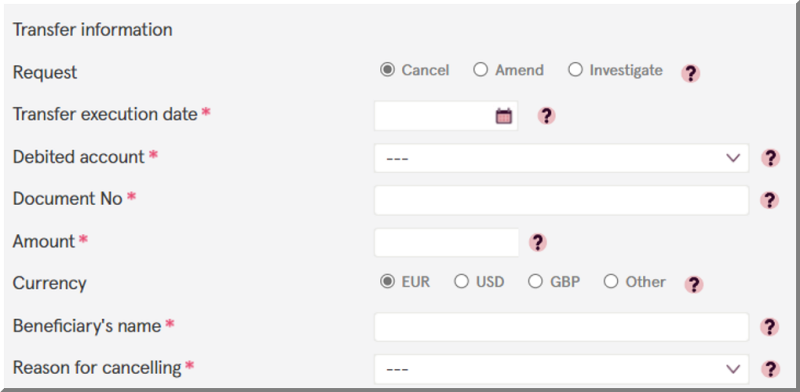

b) If the payment status is Executed, you will need to fill out a request. Select Applications → New Application choose the document group Transfers and complete the request form Request to cancel/amend/investigate a transfer. In the application, be sure to select the action Cancel:

2. By visiting the nearest bank's customer service center and submitting a request.

3. By calling the bank at +370 5 239 3444.

Rejected – your submitted application has been rejected. You can find the reason for rejection by checking your received messages or in the Applications → My Applications section.

Confirmed – the cancellation process has been initiated based on your submitted application.

1. Based on the client's request, the bank contacts the recipient's bank or the correspondent bank and requests to cancel the payment.

2. In cases where the funds have already been credited to the recipient or sent to the recipient's bank, the return of the funds depends on the recipient's decision.

3. Typically, in the case of SEPA payments, a response from the recipient’s bank regarding the recipient’s consent or refusal to return the funds is received within 15 business days from the submission of the request to the recipient’s bank. The resolution for an international payment refund may take longer.

4. If the recipient agrees to return the funds, the bank awaits the return. Once the funds are received, they are credited to the client’s account as soon as possible.

5. Clients are informed about the result of the transfer cancellation process by phone or via a message in Internet Bank.

- If a SEPA transfer is submitted after the cut-off time on Friday or the day before a public holiday, over the weekend, or on public holidays, the clients can cancel the payment themselves until the bank debits it from the account.

- If a transfer in another currency to other banks is submitted after the cut-off time on a business day, on Friday, or the day before a public holiday, over the weekend, or on public holidays, the clients can cancel the payment themselves until the bank debits it from the account.

- The bank charges a commission fee for the transfer cancellation as set in the fee schedule. This fee is applied regardless of whether the recipient agrees to return the funds.

- The correspondent bank and/or the recipient’s bank may apply an additional commission fee for the cancellation of the transfer.

Transfer amendment

- You can amend payments made in another currency to countries in the European Economic Area (EEA), within Lithuania and within the bank, as well as in euros or another currency to non-EEA countries. Important: the amount, currency, execution date, and payer's account cannot be amended.

- SEPA and instant payments also cannot be amended.

1. In the Internet Bank select Payments → Payments List. Find the payment that you want to amend:

a) If the payment is not marked as Executed, select the payment and click Reject/delete selected.

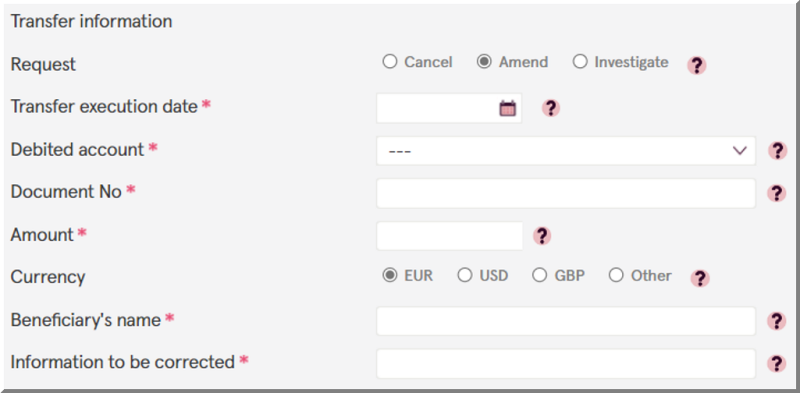

b) If the payment status is Executed, you will need to fill out a request. Select Applications → New Application, choose the document group Transfers, and complete the request form Request to cancel/amend/investigate a transfer. In the application, be sure to select the action Amend:

2. By visiting the nearest bank's customer service center and submitting a request.

Rejected – your submitted application has been rejected. You can find the reason for rejection by checking your received messages or in the Applications → My Applications section.

Confirmed – the amendment process has been initiated based on your submitted application.

1. According to the client's request, the bank contacts the recipient's bank / correspondent bank and requests an amendment of the payment information.

2. The payment amendment timeline depends on the internal processes of the recipient's bank / correspondent bank.

3. Clients are informed about the result of the transfer amendment process via a phone call or a message in Internet Bank.

- The bank charges a service fee according to the pricelist for transfer amendment.

- The correspondent bank and/or the recipient's bank may charge a commission fee for the amendment of the transfer.

Transfer investigation

If you've made a transfer and the recipient hasn't received it or received it later than expected, you can request a payment status confirmation.

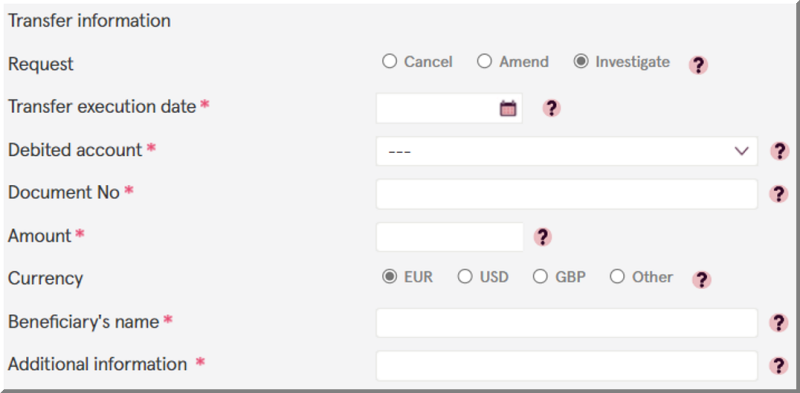

1. In the Internet Bank select Applications → New Application, choose the document group Transfers, and complete the request form Request to cancel/amend/investigate a transfer. In the application, be sure to select the action Investigate:

2. By visiting the nearest bank's customer service center and submitting a request.

Rejected – your submitted application has been rejected. You can find the reason for rejection by checking your received messages or in the Applications → My Applications section.

Confirmed – investigation process has been initiated based on your submitted application.

- According to the client's request, the bank contacts the recipient's bank / correspondent bank and requests confirmation of the payment status.

- The payment investigation timeline depends on the internal processes of the recipient's bank / correspondent bank.

- Clients are informed about the result of the transfer investigation process via a phone call or a message in Internet Bank.

- The bank charges a service fee according to the pricelist for transfer amendment.

- The correspondent bank and/or the recipient's bank may charge a commission fee for the amendment of the transfer.

Changing transaction limits

- Log in to Internet Bank and select Applications.

- In the window that opens, click on New application on the left side, choose the document group Transfers, and fill out the request Request to change transaction limits on the internet bank.

Rejected – your submitted application has been rejected. You can find the reason for rejection by checking your received messages or in the Applications → My Applications section.

Confirmed – based on your completed application, the transaction limits have been changed.

- We will process the received application within 3 business days. If you have any questions, please contact us by phone at +370 5 239 3444 or by email at [email protected].

- You can view your transfer limits in the online bank by selecting Payments → Payment limits.

- In case of legal entities, a user with account administrator rights can view the payment limits for all managers in the online bank by selecting "Settings" and clicking "Account and access rights management". More information about this feature, account management, and rights can be found in the Instruction for accounts and access rights management.

You can review the applicable standard limits here.

Ordering a SWIFT or SEPA copy

- You can generate a standard Payment Order for outgoing payments yourself in the Internet Bank free of charge. In the Payments section, select Payment list, find the required payment, and click on the Print action.

- If the Payment Order is not sufficient for the recipient, the bank can prepare a confirmation of the payment copy (SWIFT or SEPA).

- Log in to Internet Bank and select Applications.

- In the new window, on the left side, click New application, select the document group Transfers, and fill out the request form for Request to send a SWIFT copy.

Rejected – your submitted application has been rejected. You can find the reason for rejection by checking your received messages or in the Applications → My Applications section.

Confirmed – based on your completed application, a confirmation of the SWIFT or SEPA copy has been sent to your email.

- The SWIFT or SEPA copy will be sent to you via email within 1 business day from the submission of the request.

- The bank charges a commission fee for the preparation of the SWIFT or SEPA copy, as specified in the price list.