Supplementary pension schemes to employees | Luminor

Supplementary pension schemes to employees

Supplementary pension schemes to employees

Are you motivating your employees?

- The employer's financial incentives for pension is a financially attractive and popular way to motivate employees

- A voluntary retirement savings program benefits employees and increases their income at the same or lower cost to the company.

41 %

of employees state that by contributing to pension, the employer shows care about the long‑term well‑being of the employee

42 %

of employees rate employer's contibutions for retirement as the most motivating tool among the benefits offered by the employer

34 %

employees claim that accumulating a pension at the employer's expense helps maintain employee loyalty to the workplace

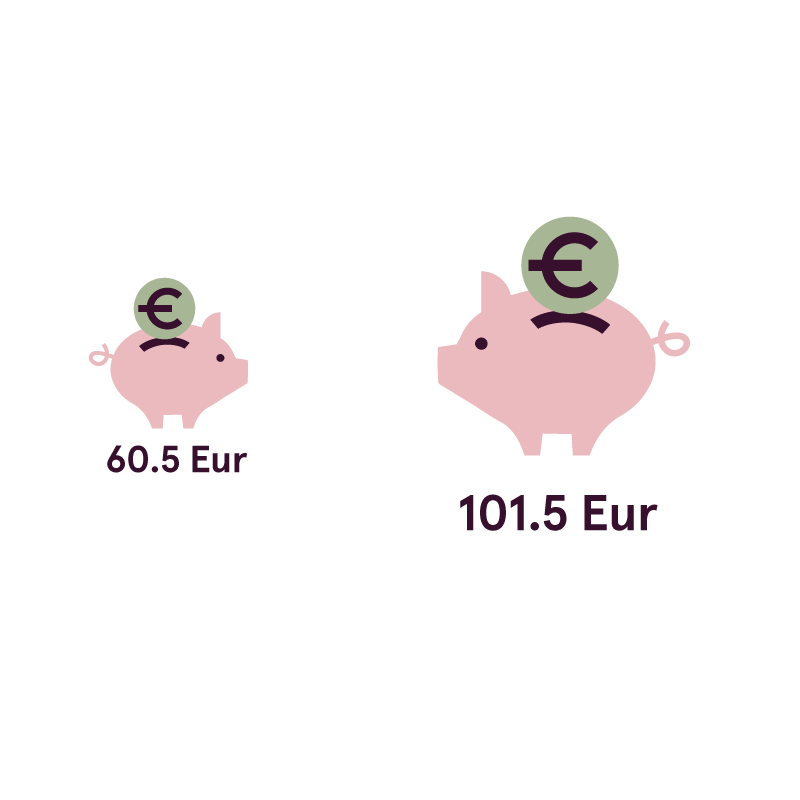

Encourage an employee to spend 68 % more by spending the same amount – 102 euros

The employer allocates €100 “before taxes” to motivate an employee and gives a choice of motivation – payout or long term retirement savings

Salary increase after taxes 60.5 euros

Occupational retirement in favour of an employee 101.5 euros*

Read more >>

Long-term experience

20 years of managing pension funds

The first in Lithuania

Launched sustainability‑oriented pension fund – Luminor tvari ateitis index

Easy to choose

Name of the pension fund indicates which age group it is most suitable for

Motivate your employees with long-term benefits

Contacts

Vilnius

Elinga Žemaitienė +370 616 97683

Elinga Žemaitienė +370 616 97683

Violeta Milevska +370 620 40631

Violeta Milevska +370 620 40631

Kaunas, Šiauliai, Panevėžys

Nomeda Bardauskienė +370 614 01613

Nomeda Bardauskienė +370 614 01613