Luminor Supplementary Pension | Luminor

Would you survive on 44 %?*

Would you survive on 44 %?*

- Choose 3rd pension pillar and contribute to your retirement income

- It is easy to choose the most suitable pension fund

*After evaluating the average social ratio of the pension and the country's average net wage in 2024 II quarter

Getting ready for your future?

Luminor III pension pillar benefits

Accumulated assets are inherited

Solid long-term investment results – for example, Luminor ateitis 16‑50 generated a return of 7.87 % on average in the last 10 years*

Choose a more sustainable way of saving for pension

Choose the most suitable savings strategy for you

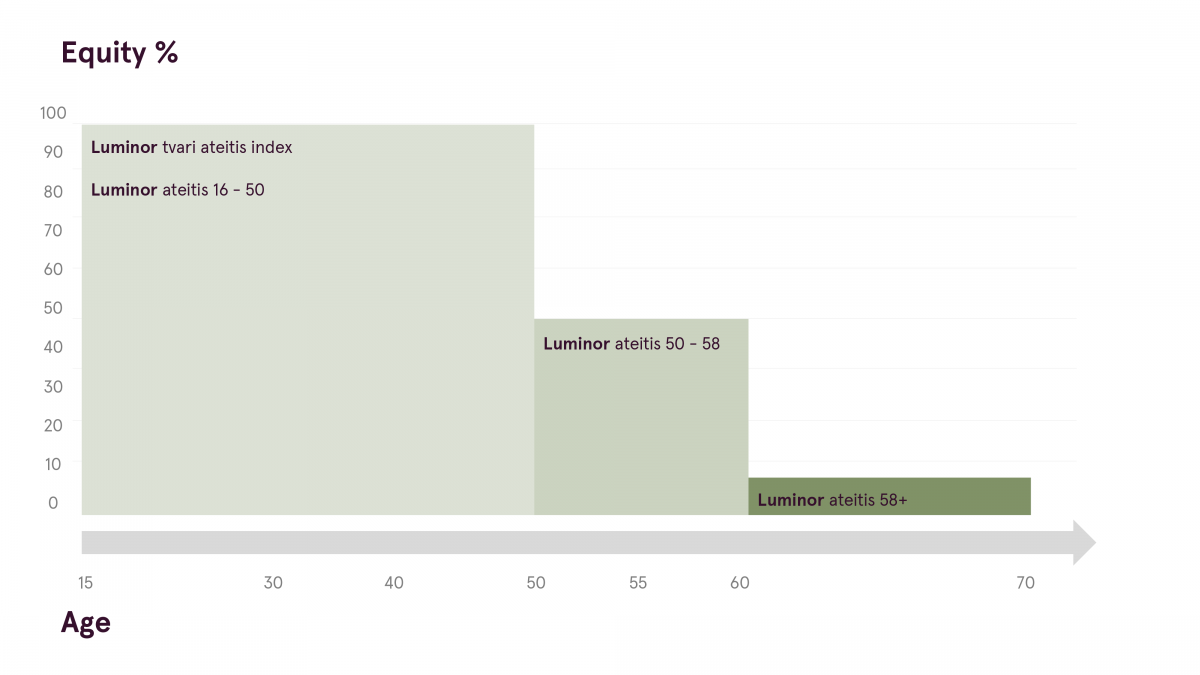

| Age of saver | Proportion of shares* | Pension plan / strategy ** |

|---|---|---|

| 16-50 years | Up to 100 % | Luminor tvari ateitis index |

| 16-50 years | Up to 100 % | Luminor ateitis 16–50 |

| 50-58 years | Up to 50 % | Luminor ateitis 50–58 |

| Older than 58 years | No investment into shares | Luminor ateitis 58+ |

** You can choose to make contributions to one or more pension plans depending on your investment maturity and the most suitable proportion of shares.

Choose a pension fund:

- Fund is a high-risk fund with up to 100 percent assets can be invested in stock markets.

- The global direction of the equities has been chosen, the long-term return of which is more stable compared to the return of funds established on a sectoral or regional basis.

- Suitable for 16y-50y savers who seek high ESG* standards for their pension savings

Created for savers looking for potentially higher return in long-term perspective and assuming big fluctuations in value.

- Up to 100 % of assets can be invested in stock markets.

- High-risk fund.

- Suitable for 16y-50y savers

Created for savers looking for potentially higher returns in a long-term perspective and assuming big fluctuations in value.

- Maximum 50 % of assets can be invested on stock markets.

- Medium risk fund.

- Suitable for 50y-58y savers

Created for savers looking for the balance combination of return and risk.

- No investment into shares

- Low risk fund

- Suitable for savers that are older than 58y

Created for savers looking for maximum preservation of their property value, however with potentially lower return.

Luminor pension funds

Why save in the III pension pillar? Frequently asked questions

Saving for retirement is a long-term process. It is common to experience various market fluctuations over a long period of time, but history shows that market downturns are replaced by periods of upswing, and vice versa - after an upswing, it is common to experience a recession. Therefore, in case of sudden changes in the market, the most important rule is to remain calm and not make rash decisions.

During market fluctuations, it is important to invest regularly. Regular contributions to pension funds even out market fluctuations, as funds are invested both during periods of market growth and decline. Since saving for retirement is a long-term process, you should always focus on the continuity and regularity of contributions.

Pension funds seek to balance the investment period with the assumed risk, so as retirement age approaches, II pillar pension life cycle funds automatically change investments to more conservative ones in order to maintain asset value and avoid greater fluctuations. In case of III pillar pension funds, the names of the funds already indicate the age of the person for whom a specific fund would be most suitable, taking into account the remaining investment period and the potential risk of fluctuations. Accordingly, the “Luminor ateitis 16-50” fund provides a longer investment period and assumes a greater risk of fluctuations, while the “Luminor ateitis 58+” fund has a shorter horizon and seeks to maintain asset value with a lower risk of fluctuations.

As history shows, a longer investment period and greater assumed risk allow you to earn higher returns, despite greater short-term price drops. For example, the value of the long-term investment horizon fund "Luminor ateitis 16-50", which invests exclusively in stocks, could decrease by up to 31.2 % per year in the worst-case scenario, but the average return of this fund over the past 10 years exceeded 5.8 % per year.

After the amendments to the Personal Income Tax Law approved by the Seimas, the personal income tax (PIT) benefit for contributions to III pillar pension funds is cancelled. For contracts concluded before 31st of December 2024, and for contributions based on these agreements, paid until 31st of December 2034, this benefit can still be applied for 10 years. For contracts concluded from 1st of January 2025, the PIT benefit will not be applicable.

If III pension pillar contract was concluded before 31st December 2024, it is possible to take advantage of the personal income tax relief and recover up to 20 % of the contributions made during the calendar year to III pillar pension funds, not exceeding 25 % of the annual salary, but not more than EUR 1,500. In this way, a total of up to EUR 300 per year can be recovered.

The numbers indicate the age of persons, whose expectations could be met most accurately by choosing this fund, taking into account the individual's life cycle.

It is recommended to review your personal strategy for the third pension pillar savings regularly, considering the risk level of the pension fund, your age, and your expected investment return. As retirement age approaches, it is recommended to consider switching the fund to a more conservative "Luminor ateitis 58+" in order to reduce potential investment risk.

When saving for retirement, it is important to choose an investment strategy that fits your goals. The chosen strategy plays an important role in determining the potential performance of your investment.

The basic rule for choosing a long-term investment strategy is that younger people should invest in the most aggressive funds, which have maximum equity proportions and also the greatest return potential. The reason behind it is that historically stocks have proven to have a higher return than bonds, but they are also riskier – meaning their value can also fall more during turbulent times.

Our recommendation is that you change your pension fund when you reach closer to retirement age. Then it is time to gradually scale down the risk by moving to the next fund based on your age.

Yes, it is possible, but it is very important to familiarize yourself with the pricelist of pension funds and other taxation conditions. Funds withdrawn from the III pillar pension funds will not be subject to income tax if all below conditions are met:

- The participant has reached the minimum retirement age* (5 years lower than the old‑age pension age),

AND - The validity period of the pension fund contract is not less than 5 years from the first payment.

More information is in Article 17 of GPMI.

*Also, when the contract was concluded before 2012 12 31 and the person has reached the age of 55, or when the customer has 0‑25 % or 30‑40 % disability.

Useful links

Consultation on saving for retirement

Pricelist

Information about pension funds and documents

Don’t know what to do?

Important information for switching III pillar pension funds internally

Important information about the merge of Luminor III pillar pension funds

See also: Investment, II Pillar Pension Funds, Term Deposit