Lithuania: Coronavirus will test resilience to economic recession | Luminor

Lithuania: Coronavirus will test resilience to economic recession

Žygimantas Mauricas

Luminor Chief Economist

Abstract

- At the turn of the year, the global economic skies began to brighten as a result of the truce in the US-China trade war, greater clarity concerning Brexit, the surprising resilience of EU peripheral countries, and exceptionally rapid US economic growth.

- The light at the end of the tunnel was already visible, but it turned out that this was actually the headlights on the coronavirus train, which renewed fears of a global recession.

- We have yet to see what the final impact of the pandemic will be on the global economy, but in the most likely scenario, the European Union will experience a recession in the first half of 2020, after which the economy will return to its normal path of growth (assuming that the epidemic will last for two quarters).

- Lithuania should be able to avoid a recession, but economic growth will slow down to a mere 1.6% in 2020.

- Resilience of Lithuanian economy is enhanced by the “Germanisation” of the Lithuanian economy (i.e. positive government budget and external balances) and sustainable and balanced growth, which is driven by household consumption, exports and investment.

- Lithuania demonstrated remarkable resilience to the global economic slowdown in 2019: Lithuania’s GDP grew by 3.9%, compared to growth of just 1.5% in the European Union. In addition, Lithuania was one of the three EU countries with faster GDP growth in 2019 than in 2018.

- For the third year in a row, the Lithuanian economy grew faster than expected: GDP growth averaged 3.9%. We believe that this is not a coincidence but rather – a systemic change caused by the following factors: the “Germanisation” of the Lithuanian economy, Lithuania’s transformation from a migrant donor to a migrant magnet, a breakthrough in attracting industrial investment, more even regional development, extremely rapid growth in exports of high value-added services, and low inflationary pressures due to growing competition and the introduction of new technologies in the trade sector.

- Lithuania is entering a league of more rapid economic growth, so once the coronavirus outbreak is over, we expect growth to accelerate to 4.6% in 2021. We can expect growth rates of 3.0-4.0% in 2022-2023 as well. Lithuania will likely be the fastest growing economy in the Baltic States.

- The biggest threats to economic development come from the spread of the coronavirus, the rise in protectionist sentiment around the world, the strengthening euro, renewal of the EU migration crisis, the ongoing uncertainty about Brexit, and the endless military conflicts and geopolitical unrest in the European Union’s neighbourhood. The regulatory framework of the Mobility Package may also significantly reduce export volumes for road freight transport services.

The global economy has caught the recession virus

At the turn of the year, the global economic skies began to brighten as a result of the truce in the US-China trade war, greater clarity concerning Brexit, the surprising resilience of EU peripheral countries, and exceptionally rapid US economic growth. After hitting a low in October 2019, the European Union Economic Sentiment Indicator began to rise moderately, thereby reducing the risk of a recession. Economists could already see the light at the end of the tunnel, but it turned out that this was actually the headlights on the coronavirus train, which significantly increased the likelihood of a global recession. The main source of fear is uncertainty, because no one knows what the duration or scale will be of this unexpected global pandemic.

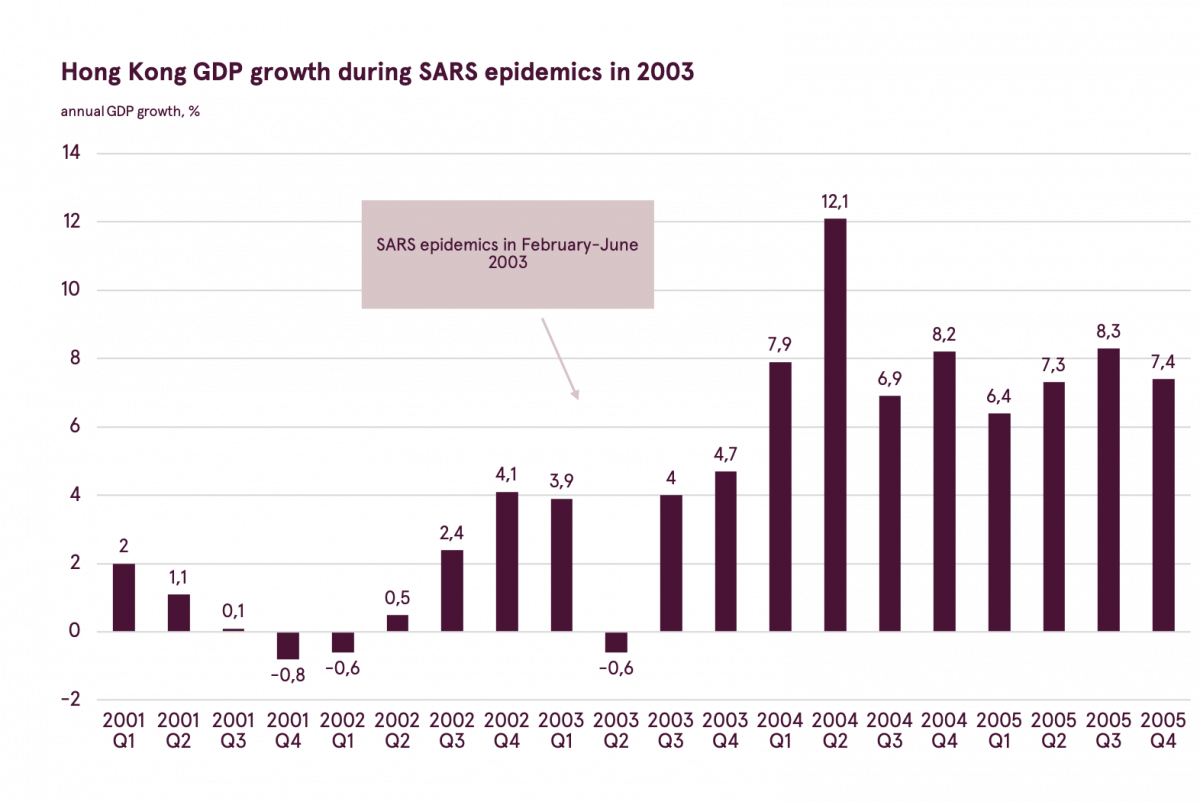

The situation is aggravated by the fact that, unlike the SARS outbreak in 2003, the coronavirus has spread widely beyond China, so the threat is no longer just on the supply side (due to disrupted production chains) – it is on the demand side as well (due to lower demand for tourism, leisure and other services and goods). If the virus were to infiltrate the United States, which generates nearly a third of the world’s consumption, a global economic recession would become inevitable. However, it is encouraging that in most cases (such as SARS in 2003 or swine flu in 2009), virus outbreaks only last one or two quarters, and once they pass, economic growth quickly gets back on track. For example, Hong Kong, where the SARS outbreak lasted from February to June 2003, experienced a recession, but only in the second quarter of 2003. Once the threat of the epidemic passed, economic growth accelerated to 4.0% in the third quarter of 2003, and – driven largely by economic stimulus measures – reached 8% in 2004. Interestingly, housing prices in Hong Kong went up by as much as 25% in 2004. This scenario will not necessarily repeat itself this time, but we should not wave aside the possibility that the actions taken by central banks and governments to stimulate the economy once the threat of the virus has passed may create stock market and real estate price bubbles again.

We predict that in the most likely scenario, the European Union economy will experience a recession in the first half of 2020, after which economic growth will get back on track. The Lithuanian economy should be able to avoid a recession, but economic growth will decline to a mere 1.6% in 2020. Lithuania will be able to avoid recession due to less dependence on tourism (e.g. Italy) and international production chains (e.g. Germany). Lithuania’s recession resistance is also enhanced by the “Germanisation” of the Lithuanian economy (i.e. positive government budget and external balances) and sustainable and balanced growth, which is driven by household consumption, exports and investment. Lithuania has repeatedly demonstrated its resilience to external environmental shocks by generating positive growth in the face of both the European sovereign debt crisis and the Russian financial crisis. Lithuania also demonstrated remarkable resilience to the global economic slowdown in 2019: Lithuania’s GDP grew by 3.9%, compared to growth of just 1.5% in the European Union.

Lithuania is entering a league of more rapid economic growth

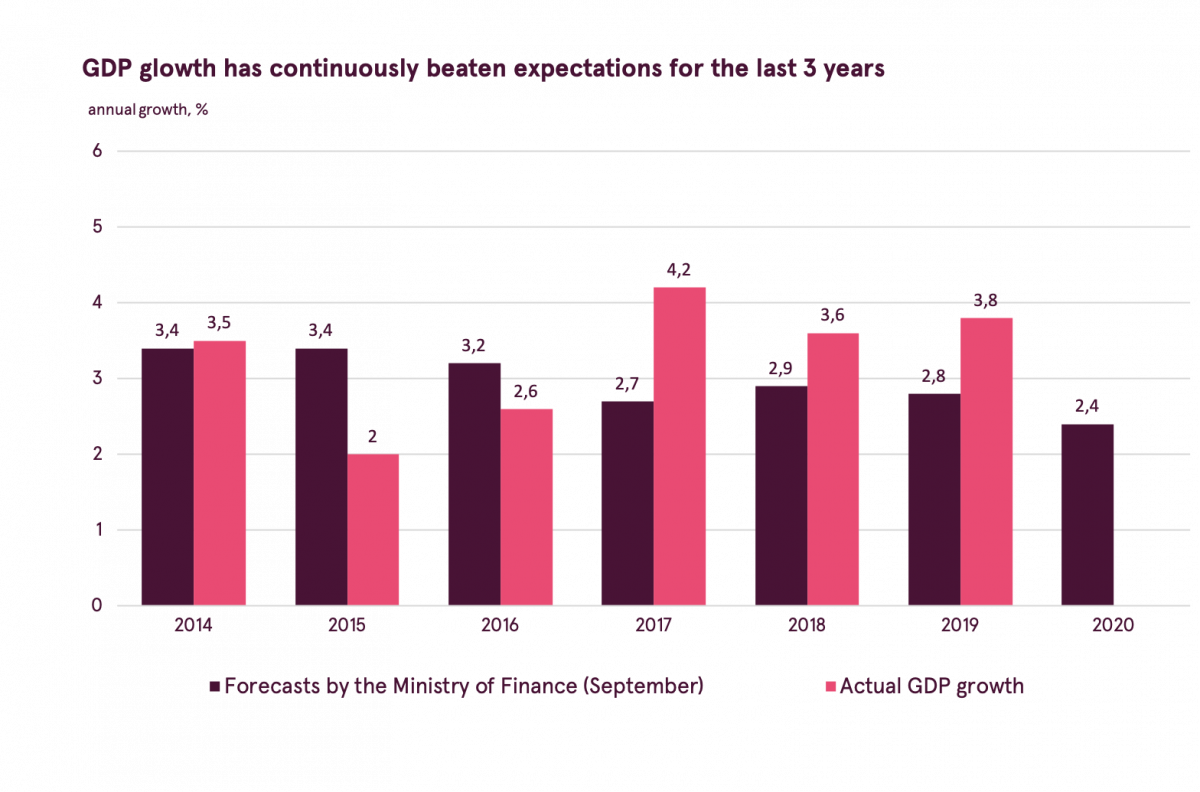

For the third year in a row, the Lithuanian economy is growing faster than expected. For example, the September macroeconomic projections prepared by the Ministry of Finance of the Republic of Lithuania (which are used to form the government budget for the coming year) predicted GDP growth of 2.7%, 2.9% and 2.8% in 2017, 2018 and 2019 respectively, but actual growth was well above expectations, reaching 4.2%, 3.6% and 3.9% respectively, i.e. on average, actual growth was 1.1 percentage point higher than projected.1 The faster-than-expected GDP growth made it possible to maintain a positive government budget balance even in the face of rapid expenditure growth, and to replenish the country’s fiscal reserves, which went from 0.5% to 2.2% of GDP in three years.

Was the faster-than-expected economic growth in Lithuania driven by temporary factors (happy coincidence) or by structural changes in the country that elevated Lithuania to a higher league of economic growth? In our estimation, the structural changes which have taken place in the country over the past decade and have significantly increased Lithuania’s potential economic growth played a more important role. The European Commission estimates that Lithuania’s potential economic growth for 2020-2021 is 3.9% and is the fastest among the Baltic States (Estonia – 3.5%, Latvia – 3.4%, Poland – 4.0%, European Union – 1.6%). For comparison, Lithuania’s potential economic growth for 2013-2016 was estimated at just 1.9%.

We therefore predict that once the coronavirus outbreak is over, Lithuania’s economic growth will accelerate to 4.6% in 2021. We can expect growth rates of 3.0-4.0% in 2022-2023 as well, with Lithuania likely being the fastest growing economy in the Baltic States. The following factors contributed to Lithuania’s leap into a league of more rapid economic growth.

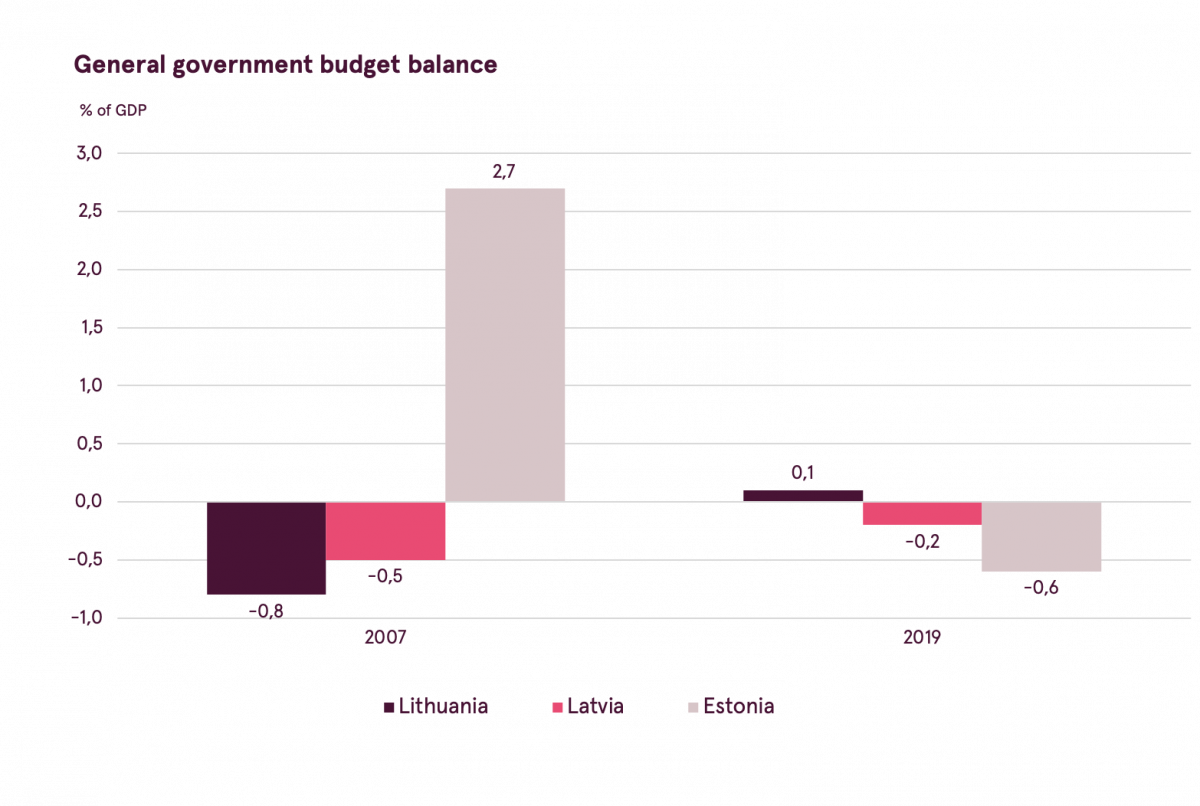

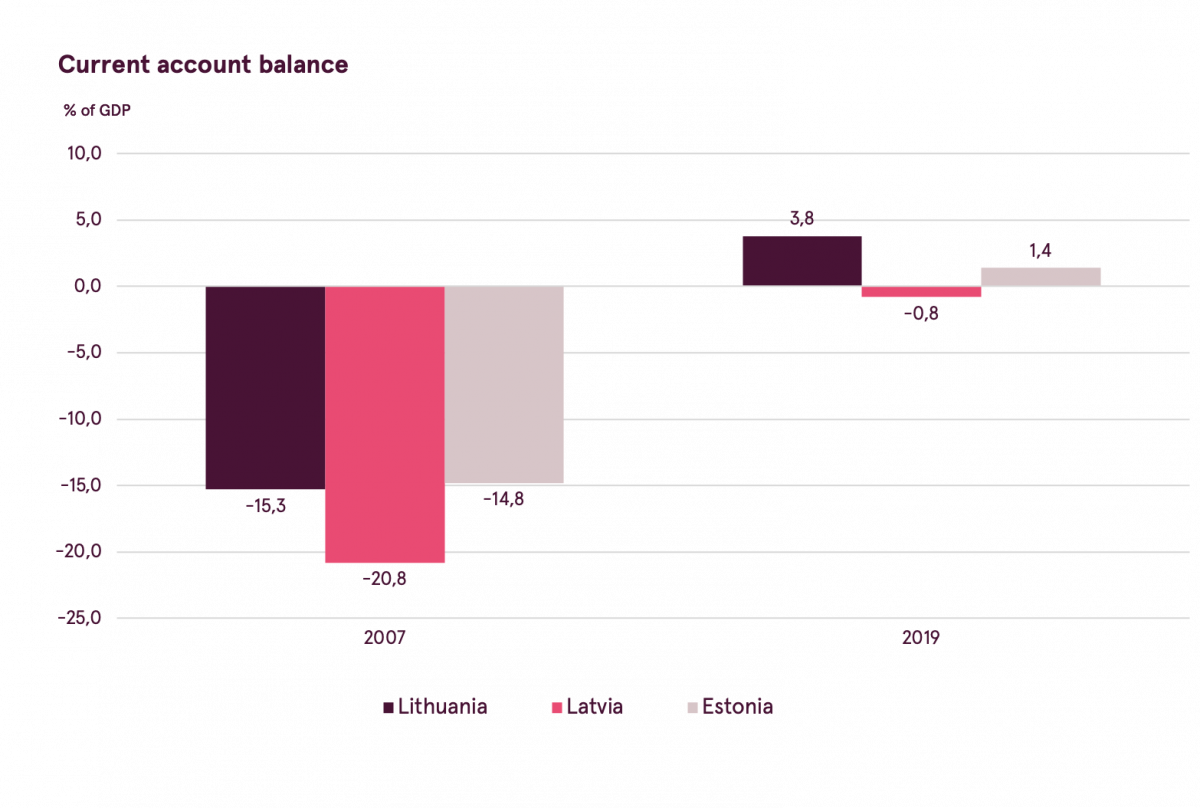

- “Germanisation” of the Lithuanian economy. Unlike before the 2008 financial crisis, Lithuania has positive external and government budget balances. The positive current account balance has reduced Lithuania’s dependence on external financing, while the positive government budget balance and considerable fiscal buffer have boosted international institutions’ confidence in Lithuania and reduced the likelihood that Lithuania will have to resort to a belt-tightening policy if hard times come along. The growing confidence in Lithuania is well illustrated by the decision taken by Standard & Poor’s to give Lithuania its highest long-term credit rating ever. The willingness of international investors to lend to Lithuania with negative interest rates (i.e. investors are actually paying Lithuania extra for the opportunity to acquire its debt securities) is not diminishing either. In addition, both the external balance and the government budget balance in Lithuania are the best in the Baltic States, so you could say that Lithuania has “Estonianised”, i.e. taken over the role as the leader in sustainable growth from Estonia.

- Lithuania’s transformation from a migrant donor to a migrant magnet. In the European Union, Lithuania is the country that has lost the largest portion of its population to international migration. In its first 15 years as a member of the EU, Lithuania lost over 400,000 residents – or 12% of the population – due to international migration (Latvia is second with 9% and Romania is third with 6%). It was this ruthless statistic that was one of the main factors leading to the conservative assessment of Lithuania’s potential economic growth and demographic development. However, the situation changed radically in 2019, and for the first time since the restoration of independence, Lithuania had a positive net migration rate (+10,800). The positive net migration rate was both due to increased immigration of both third country (primarily Ukrainian) nationals and returning Lithuanian nationals. We are forecasting that the net migration rate in 2020 will be positive and will reach 20-25,000. We are also forecasting that for the first time since the restoration of independence, the net migration rate of Lithuanian citizens will be positive (in 2019, it was still negative at -4,100). The number of employed individuals will grow accordingly, increasing potential economic growth.

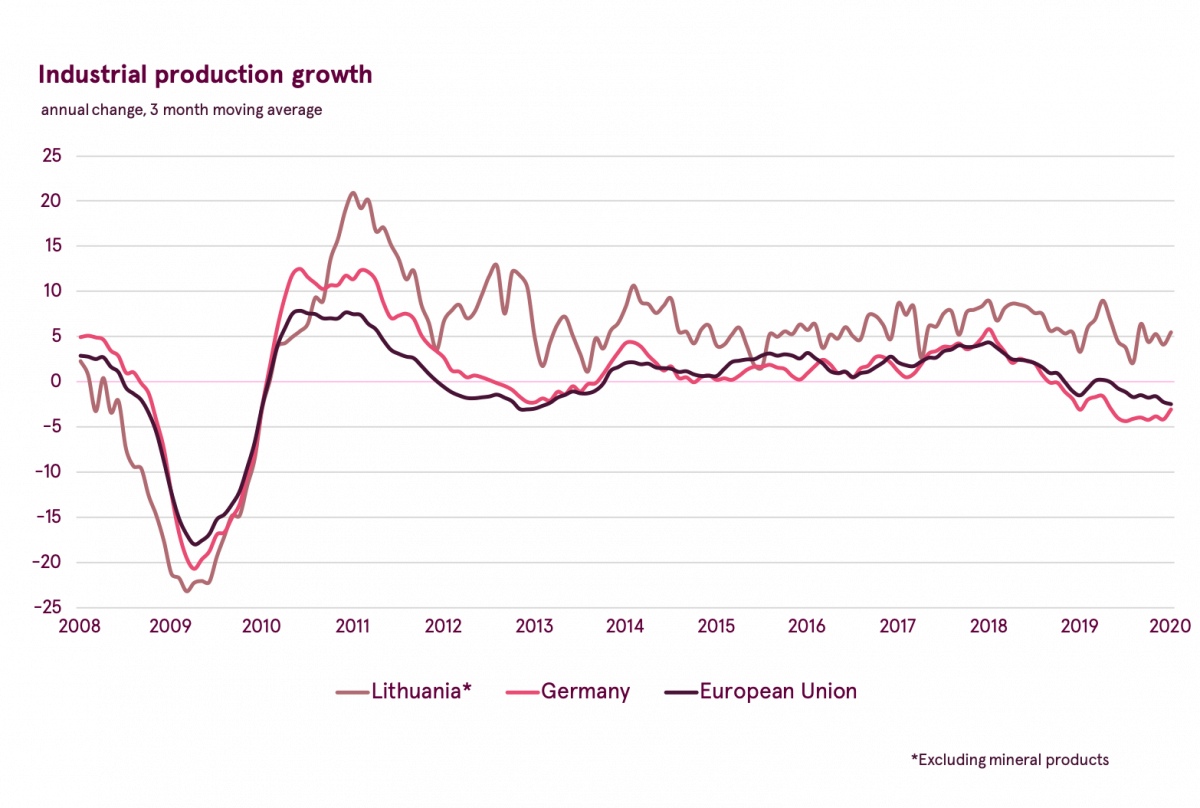

- A breakthrough in attracting industrial investment. Lithuania has had a breakthrough in attracting industrial investment, which is well illustrated by the opening of the Continental factory in Lithuania (the opening of the Barclays service centre in Lithuania in 2009 played a similar role in breaking the ice for investment in the high value-added services sector). The breakthrough in investment in new plants has made it possible to maintain positive growth in the industrial sector, despite the global slowdown in the industrial sector. Lithuanian industrial production grew by 5.4% in 2019, even though it shrank by an average of 1.0% in the European Union as a whole, with a drop of as much as 3.4% in Germany. We forecast that industrial growth in Lithuania will slow down in 2020, but will still remain positive, and should return to a path of rapid growth in 2021.

- Lithuania is no longer a one-city country. Growing industrial sector investments will reduce the gap between Vilnius and the rest of Lithuania, as most of the industrial sector investment projects are being implemented outside of Vilnius (mainly in Kaunas and Klaipėda). Recent demographic statistics show that Vilnius is also no longer the only city in Lithuania that is growing in terms of population. The population has increased not only in Vilnius, but in Kaunas, Klaipėda and Šiauliai as well. This gives hope that unlike Latvia and Estonia, Lithuania will not become a one- or two-city country. However, in order to become full-fledged cities of the 21st century, Klaipėda and Šiauliai need to grow the high value-added services sector, because the industrial sector will not be able to create a sufficient number of well-paid jobs, so the risk that the brain drain from these cities will continue still exists.

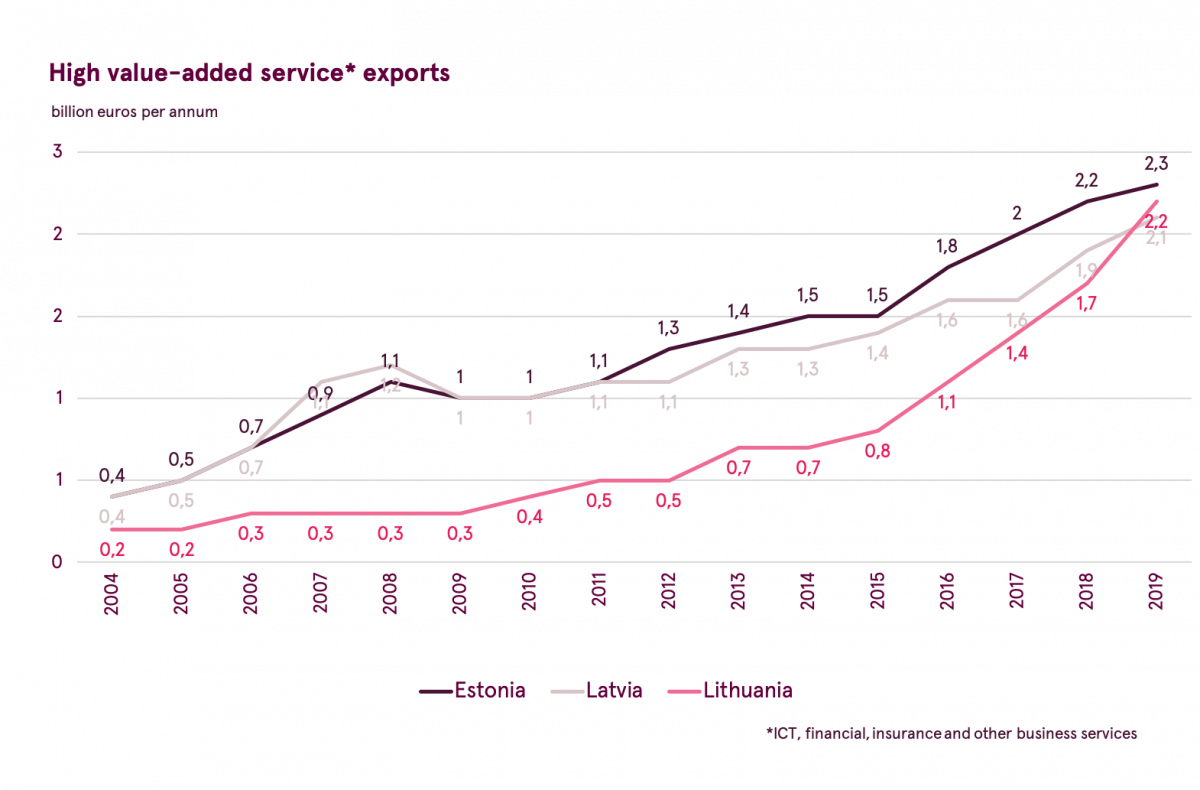

- Lithuania is becoming the leader in the Baltic States in the export of high value-added services. Lithuania’s exports of high value-added services have doubled over the past three years from EUR 1.1 billion to EUR 2.2 billion per year. In terms of export volumes, Lithuania has caught up with Latvia and Estonia, and is expected to take the lead this year. Our optimistic forecasts are based on the fact that Vilnius is the clear leader in modern office space development in the Baltic States, and that Lithuania’s position is further strengthened by the city of Kaunas, which is demonstrating an impressive growth rate. Growth is not expected to slip in the next two years and will remain the fastest in the Baltic States. Lithuania will become the leader in the Baltic States in the export of high value-added services.

- Increasing competition is limiting inflation. Average annual inflation in Lithuania in 2019 was barely 2.2%, despite the extremely rapid household income growth (e.g. net wages increased by as much as 14.1%). Inflation in Lithuania was one of the lowest in the CEE and Baltic countries, and was just 0.7 percentage points above the European Union average (1.5%). The relatively low inflation in Lithuania was driven by increasing competition, which resulted in a general decline in price levels in certain segments (e.g. clothing and footwear). Prices of goods in Lithuania only increased by 1.4% in 2019, which is a mere 0.2% above the EU average (1.2%). On the other hand, at 4.6%, the increase in service prices was the fastest in the European Union; however, this was largely driven by rising costs due to the extremely high wage growth. The most worrying is the relatively rapid increase in food prices, which accelerated to 5% in early 2020. Given that Lithuanian households spend more than a fifth of their income on food, this may have a negative impact on household sentiment.

The coronavirus pandemic is not the only threat to economic growth

All other threats pale in the face of the coronavirus pandemic, but some of them may reduce Lithuania’s potential economic growth. In particular, unfavourable provisions for Lithuania in the EU Mobility Package (e.g. requiring trucks to return to their country of registration every eight weeks) may limit the growth of transport services exports to the West and encourage some Lithuanian carriers to relocate to other EU jurisdictions. Given that the export of road freight transport services accounts for more than 8% of the country’s total exports, the negative impact of regulatory changes on overall economic growth may be significant. In addition, the ongoing coronavirus outbreak may significantly reduce demand for road transport services, which could further exacerbate the potential downturn in the sector. Secondly, the coronavirus outbreak could fuel the rise in protectionist sentiment around the world, leading to a general decline in world trade. In addition, the endless military conflicts and geopolitical unrest in the European Union’s neighbourhood (Syria, Libya, Ukraine, Lebanon, Iran, Afghanistan, Saudi Arabia) could lead to a renewed EU migrant crisis that could shake the foundations of the Schengen Area. Finally, the spread of the coronavirus in Italy and other vulnerable economies in the European Union may revive memories of the European sovereign debt crisis. Likewise, a hard Brexit scenario cannot yet be completely ruled out, as failure to agree on a UK-EU trade pact this year could lead to the Brits leaving the community without an agreement. Lastly, aggressive US central bank interest rate cuts may lead to the strengthening of the euro, which would undermine the international competitiveness of the euro area, as well as of Lithuania. Materialisation of these threats would be painful for the small, open and export-dependent Lithuanian economy, so potential economic growth would decrease. However, we hope that the coronavirus pandemic will mobilise countries around the world to fight a common enemy, so there will be more cooperation than division.

1Luminor (formerly Nordea) bank’s September Lithuanian GDP forecasts were 3.0%, 3.5% and 3.3% respectively, i.e. on average, actual growth was 0.6 percentage points higher than projected.