Volatility came back during first month of autumn | Luminor

Volatility came back during first month of autumn

- ECB expects faster growth

- Fed soon will probably start scaling back asset purchases

September brought bigger fluctuations in financial markets. World equity index1 lost 2.4% of its value and bonds2 dipped bit more than 1%. Market participants tried to evaluate newest US Fed and European central bank (ECB) statements and investors were spooked by financial troubles of Chinese real estate developer. Also everyone’s attention was focused on newest inflation data in order to see if recent spike in prices is indeed “transitionary”, the way central banks are expecting it to be.

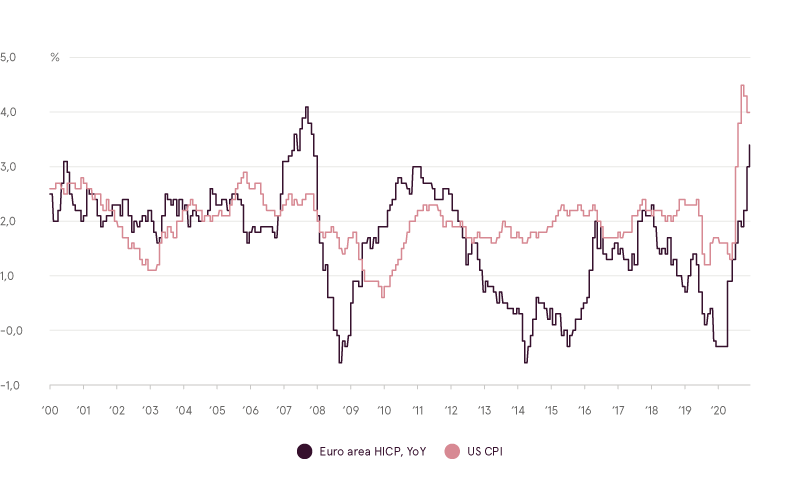

In mid-September ECB kept interest rates unchanged, but adjusted the size of asset purchases under the Pandemic Emergency Purchase Programme (PEPP). ECB will now conduct the purchases at “a moderately lower pace than in the previous two quarters”. ECB President Christine Lagarde called it, “a recalibration”. It is expected, that central bank will buy securities from 60bn to 70bn euro per month until the end of the year. Also ECB revised upwards GDP growth projections for this year to 5%, from 4.6% in June. Regarding inflation, the ECB expects inflation to rise further this autumn, but to decline next year. Latest projections show, that this year headline inflation should come in at 2.2%, 1.7% in 2022 and 1.5% in 2023, from 1.9%, 1.5% and 1.4%, respectively.

Inflation in eurozone and US

Source: Bloomberg LP

One important development took shape in September. US policy makers moved towards agreeing on new taxes. New draft showed that they would scale back the more ambitious tax increases sought by Biden, but still it will be a significant unwinding of the tax cuts enacted by Republicans under former president Donald Trump four years ago. New proposal offers to increase the top tax rate on Americans earning over 435,000 USD from 37% to 39.6%, it also calls for a new corporate tax rate of 26.5% for large profitable businesses, up from the current rate of 21% but lower than President Biden’s original proposal of 28%. This could impact earnings for many S&P 500 companies and willingness to invest in the market by wealthy individuals.

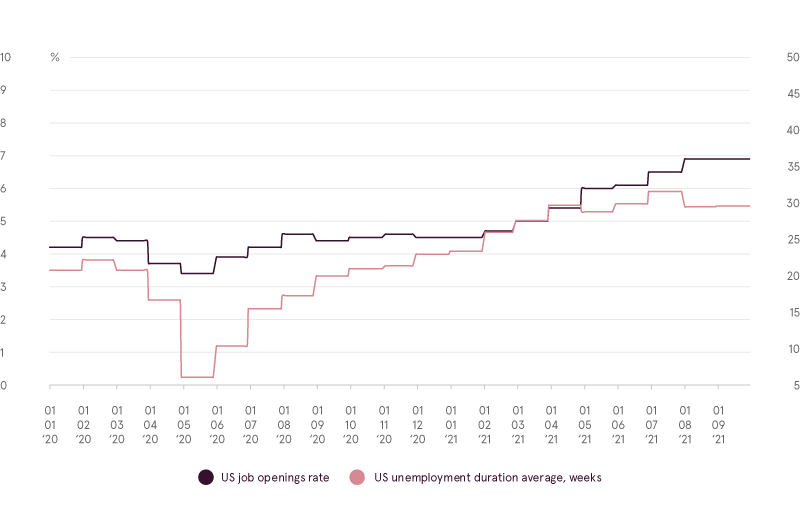

In the U.S., employers and economists expected an increase in job applications as pandemic supports that included $300 per week for jobless Americans, extended benefits for the long-term unemployed and special aid for the self-employed expired Sept. 6. But the flood of job seekers has not materialized and this could have negative influence for companies seeking new workers as US Job openings are rising. Meanwhile Fed said that it would likely begin reducing its monthly bond purchases as soon as November and signaled, that interest rate increases may follow more quickly than previously expected.

US companies are hiring, but people are not rushing to get back to work

Source: Bloomberg LP

Financial markets also reacted to possible default by China's second biggest property developer Evergrande, which owes about USD 300 billion to its investors. Market participants are concerned about possible fallout from a messy collapse. On one hand a lot of analysts believe, that developer’s collapse could trigger property crash in China, but others can see it as a “Lehman moment” – liquidity crunch event, which could freeze the whole financial system and spread globally. There are still no signs, that Chinese government will step in and save the company, but central bank took steps and injected cash to contain the situation.

“House view” update

Increased volatility in the markets and few indicators prompted deterioration in our models. Small correction in the markets was widely expected, but long term rebound in global economic activity and still present financial stimulus warranted us to remain Neutral. Nonetheless we are continuously assessing the situation in the markets and will make adjustments if needed.

1MSCI ACWI Net Total Return EUR

2Bloomberg Barclays Global Aggregate Total Return hedged EUR

Warnings:

- This Marketing Communication is not considered investment research and has not been prepared in accordance with standards applicable to independent investment research.

- This Marketing Communication does not limit or prohibit the bank or any of its employees from dealing prior to its dissemination.

Origin of the Marketing Communication

This Marketing Communication originates from Portfolio Management unit (hereinafter referred to as PMU) – a division of Luminor Bank AS (reg. No 11315936, with registered address at Liivalaia 45, 10145, Tallinn, Republic of Estonia, hereinafter - Luminor). PMU is involved in the provision of discretionary portfolio management services to Luminor clients.

Supervisory authority

As a credit institution Luminor is subject to supervision by the Estonian financial supervision and resolution authority (Finantsinspektsioon). Additionally, Luminor is subject to supervision by the European Central Bank (ECB), which undertakes such supervision within the Single Supervisory Mechanism (SSM), which consists of the ECB and the national responsible authorities (Council Regulation (EU) No 1024/2013 - SSM Regulation). Unless set out herein explicitly otherwise, references to legal norms refer to norms enacted by the Republic of Estonia.

Content and source of the publication

This Marketing Communication has been prepared by PMU for information purposes. Luminor will not consider recipients of this Communication as its clients and accepts no liability for use by them of the contents, which may not be suitable for their personal use.

Opinions of PMU may deviate from recommendations or opinions presented by the Luminor Markets unit. The reason may typically be the result of differing investment horizons, using specific methodologies, taking into consideration personal circumstances, applying a specific risk assessment, portfolio considerations or other factors. Opinions, price targets and calculations are based on one or more methods of valuation, for instance cash flow analysis, use of multiples, behavioural technical analyses of underlying market movements in combination with considerations of the market situation, interest rate forecasts, currency forecasts and investment horizon.

Luminor uses public sources that it believes to be reliable. However, Luminor has not performed independent verification. Luminor makes no guarantee, representation or warranty as to their accuracy or completeness. All investments entail a risk and may result in both profits and losses.

This Marketing Communication constitutes neither a solicitation of an offer nor a prospectus in the sense of applicable laws. An investment decision in respect of a financial instrument, a financial product or an investment (all hereinafter “product”) must be made on the basis of an approved, published prospectus or the complete documentation for such a product in question and not on the basis of this document. Neither this document nor any of its components shall form the basis for any kind of contract or commitment whatsoever. This document is not a substitute for the necessary advice on the purchase or sale of a financial instrument or a financial product.

No Advice

This Marketing Communication has been prepared by Luminor PMU as general information and shall not be construed as the sole basis for an investment decision. It is not intended as a personal recommendation of particular financial instruments or strategies. Luminor accepts no liability for the use of the Marketing Communication content by its recipients.

If this Marketing Communication contains recommendations, those recommendations shall not be considered as an objective or independent explanation of the matters discussed herein. This document does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the persons who receive it. The securities or other financial instruments discussed herein may not be suitable for all investors. The investor bears all risk of loss in connection with an investment. Luminor recommends that investors independently evaluate each issuer, security or instrument discussed herein and consult any independent advisors if they believe it necessary.

The information contained in this document also does not constitute advice on the tax consequences of making any particular investment decision. The estimates of costs and charges related to specific investment products are not provided therein. Each investor shall make his/her own appraisal of the tax and other financial advantages and disadvantages of his/her investment.

Risk information

The risk of investing in certain financial instruments, including those mentioned in this document, is generally high, as their market value is exposed to many different factors. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results. When investing in individual financial instruments the investor may lose all or part of their investments.

Important disclosures of risks regarding investment products and investment services are available here.

Conflicts of interest

To avoid occurrence of potential conflicts of interest as well as to manage personal account dealing and / or insider trading, the employees of Luminor are subject to the internal rules on sound ethical conduct, management of inside information, and handling of unpublished research material and personal account dealing. The internal rules have been prepared in accordance with applicable legislation and relevant industry standards. Luminor’s Remuneration Policy establishes no link between revenues from capital markets activity and remuneration of individual employees.

The availability of this Marketing Communication is not associated with the amount of executed transactions or volume thereof.

This material has been prepared following the Luminor Conflict of Interest Policy, which may be viewed here.

Distribution

This Marketing Communication may not be transmitted to, or distributed within, the United States of America or Canada or their respective territories or possessions, nor may it be distributed to any U.S. person or any person resident in Canada. The document may not be duplicated, reproduced and(or) distributed without Luminor’s prior written consent.