Luminor joins Medus ATM network | Luminor

Luminor joins Medus ATM network

Frequently Asked Questions

Yes, Luminor customers can withdraw and deposit cash at Luminor and Medus cash machines on the same conditions.

Yes, you can withdraw and deposit cash at Medus cash machines.

Cash can still be withdrawn from SEB ATMs, however, from 5 August 2021 this service will be charged extra, as specified in the Pricelist.

Please note that by using a Luminor Black payment card, you can withdraw or deposit cash of up to EUR 600 per month at Luminor cash machines in the Baltic States and withdraw up to EUR 400 per month in other cash machines all over the world free of charge.

Cash can be withdrawn in cash machines of other banks for a fee specified in the Pricelist.

Lists of Luminor ATMs are available on the webpage luminor.lt/en/bank-network. Lists of Medus ATMs are available on the website medusatm.com.

Yes, at Luminor and Medus cash machines Luminor customers can withdraw and deposit cash, check their account balance and 5 last operations carried out on the account.

Yes, balance check and review of 5 last operations with the card (account extract) will be free of charge for customers.

Yes, eventually, all Medus cash machines will have Luminor stickers informing the customers that the cash withdrawal/cashing conditions are the same as in the LuminorATM network. But until then, same cash withdrawal/cashing conditions as in Luminor ATM network will be applied at Medus cash machines without Luminor stickers.

Eventually, Luminor cash machines will have Medus stickers.

One cash withdrawal operation limit at Medus cash machines is EUR 700. One cash withdrawal operation limit at Luminor cash machines is EUR 1000 at cash machines issuing EUR 1000 and up to EUR 2000 at cash machines issuing/accepting EUR 2000, but in all cases maximum 20 banknotes. Maximum withdrawal amount may change if certain banknotes are no longer available.

Customers can withdraw cash in the banknotes that are usually issued by the cash machine, i.e., including EUR 5 notes.

Luminor customers will be able to change their PIN codes at Luminor and Medus cash machines slightly later in the future once this function is installed.

Card types and standard cash-out limits are provided in the table below.

| Card | Total amount of cash withdrawal transactions per 25 hours, EUR |

|---|---|

| Visa Debit | 1 500 |

| Visa Classic | 2 000 |

| Visa Gold Visa Black Visa Infinite |

3 000 |

| Visa Business Visa Business Debit Visa Business Electron |

3 000 |

For the cards issued before 2020-02-01, 10 transactions limit per 25 hours is applied for the cash withdrawal.

Fees for the cash out transactions are specified in the Pricelist.

For all cash withdrawal operations, an ATM can issue no more than 20 banknotes at a time. The maximum amount of cash withdrawal and denominations of issued banknotes are subject to change if certain banknotes at an ATM are no longer available.

You can find the Luminor ATM network here.

Although it is recommended to deposit maximum 170 banknotes at once, the amount of money to be deposited is not limited.

In order to change the cash-out and payment transaction limits applicable for your card, fill in the application in the internet bank.

1. Log in to your internet bank.

2. From menu bar located at the top select "Applications".

3. In the opened window on the left side select "New application".

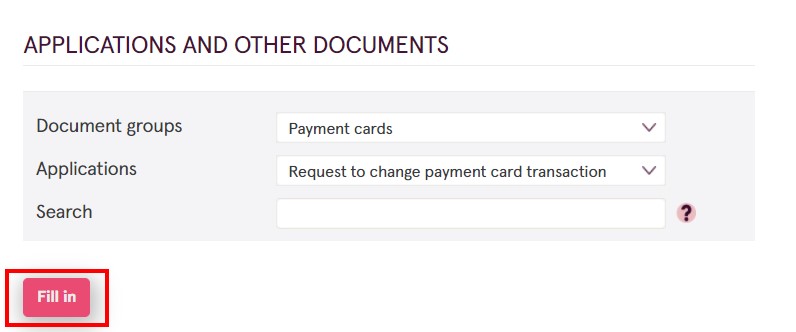

4. From the section “Document groups“ select the option “Payment cards“ and in the following row “Applications“ choose “Request to change payment card transaction“. Then press “Fill in“.

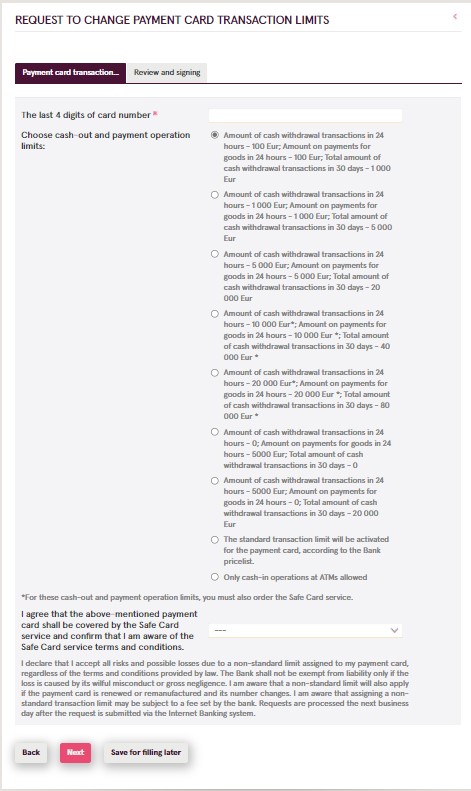

5. Fill in the application, by choosing the limits of your choice and sign it. If you have selected the higher cash-out and payment operation limits than the ones which were applied to your card, you should order the Safety+ service as well. The Safety+ service has a monthly fee per payment card. You can check the price of this service in the Pricelist.

If you fill in the application for changing your card limits on working days from 8 am to 7 pm, the limits will be changed on the same working day within 5 hours. However, if you fill in the application for changing your card limits after the aforementioned hours or on weekends / holidays, the limits will be changed on the next working day. We will inform you about the approved and fulfilled request by sending a message through the Internet bank.

Important! Keep in mind that a fee is applied for changing a card payment limits. You can check the price in the Pricelist.

However, no commission fee is applied if the customer card’s cash-out and payment operation limits are changed to standard or lower than standard.

You can cash‑out money with Luminor payment cards at ATMs all around the world and in "Perlas" terminals in Lithuania.

Fees applied for money cash‑out operations are indicated in the Pricelist. The amount of applied fees depends on the type of the payment card and the location where the money cash‑out takes place.

Fees applied for money cash‑out operations are indicated in the Pricelist. The amount of applied fees depends on the type of the payment card and the location where the money cash‑out takes place.

Please contact us by phone +370 5 239 3444 or write a letter via the internet bank.

Please contact us by phone +370 5 239 3444 or write a letter via the internet bank.

In “Perlas“ terminals you can execute cash‑in and cash‑out operations. The limit for one operation is 500 EUR yet the number of operations is unlimited.

Fees applied for money cash‑out and cash‑in operations are specified in the Pricelist.

If an ATM did not return your payment card when you were executing cash‑out or cash‑in operations, please contact us by phone +370 5 239 3444 or write a letter via the internet bank.

Have questions about our other products?