Investment opportunities in “kangaroo” market | Luminor

Rolandas Juteika, Luminor Savings and Investment products development unit manager for Baltics

2020 will be marked in equity markets history for uncertainty and unprecedented volatility

2020 will be marked in equity markets history for uncertainty and unprecedented volatility. Social media users invented a new trending term – “kangaroo” market, which defines a market that is moving with no clear direction. This kind of market is driven by emotions, not logics, and might lead to unreasoned investment decisions. Thus, the question arises what are the other investment opportunities?

According to Eurostat, the most popular choice among households in Lithuania are term deposits that yield up to 0.15% in the three largest Baltic States banks. Another investment opportunity is corporate or government bonds – fixed income financial instruments that stand for loans made by investors to borrowers. The bond investor is entitled to receive fixed interest payments until the end of the bond period when bond issuer is obliged to repay the original amount of the debt. Therefore, if an investor holds bonds until the maturity date, price fluctuation risk might be eliminated.

Lithuanian households put three times lesser portion of their savings into bond market compared to EU average, as reported by Eurostat (31/Dec/18) (Debt securities/Currency and Deposit ratio in EU is 6.3%, while in LT – 2.1%). Comparably insignificant bond positions in households’ portfolios can be explained by un-popularity caused by long investment term and higher expected returns in equity market. Accessibility to bond market for Lithuanian households is often complex and time-consuming.

“Luminor Investor clients have access to more than 1300 non-complex corporate and government bonds from more than 50 countries. It allows investors to purchase bonds in the same manner as they purchase stocks”, says Rolandas Juteika, Luminor Savings and Investment products development unit manager for Baltics.

Maturity dates of the bonds offered in the Luminor Investor range from a few days up to 48 years. Annual returns fluctuate from -0.7% to 15% accordingly (data collected from Luminor Investor on 22/Jun/2020. Investors can enter into bond purchasing agreements for as little as 1000 Eur. Eleven filters (maturity, yield to maturity, minimal investment amount, country, currency etc.) are implemented in the platform that was awarded as Smart Solution of the Year (2019) by Lithuanian Business Confederation. Commission for the bond investments - 0.20% of the transaction value (min. 15 Eur) and the custody fee – 0.01% a month (min. 0.5 Eur).

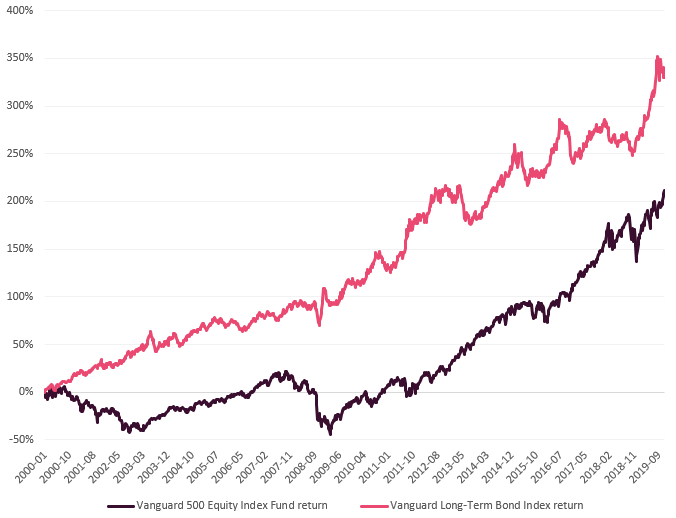

According to the New York Times magazine, bonds beat stocks over the last 20 years (Jeff Sommer, 2020). Opposing to the common belief that stocks outperform bonds in the long term: from 2000 through April 2020, the S&P 500 achieved lower annual returns (5.4%) compared to long-term Treasury bonds (8.3%), long-term corporate bonds (7.7%) and high-yield bonds (6.5%).

Change in adjusted close prices (source: Yahoo Finance).

Due to sharp interest rates fall in 2019 and uncertainty in the financial markets, bond prices increased and resulted in the most profitable year for bond investors since 2002. Major bond funds, such as Vanguard Total Bond Market Index and iShares Core U.S. Aggregate Bond funds achieved record-high returns of around 8.5% (past investment performance doesn’t guarantee same performance in the future).

Bond positions often benefit from the uncertainty. “Kangaroo” market investors tend to rush to bonds and other less volatile safe havens. On May 15th Financial Times have estimated that the new COVID-19 bond market has expanded by $65bn in a couple of months and might keep growing as “companies and governments rush to issue debt securities to help ease the effects of the pandemic” (Gross & Temple-West, 2020).

More information about Luminor Investor could be found here luminor.lt/en/investor

References

Sommer J. (2020) “Bonds Beat Stocks Over the last 20 years”. Retrieved from nytimes.com/2020/05/01/business/bonds-beat-stocks-over-20-years.html

Gross A. & Temple-West Patrick (2020) “Fund managers pile into $65bn Covid-19 bond market”. Retrieved from ft.com/content/03dbe400-1bea-4475-bda7-2fbc1d9ce062

Making banking delightfully easy