Ignoring the daily market noise and focusing on company’s fundamentals

The Nordea 1 – European Value Fund, one of the first dedicated portfolios of its kind, celebrates its 25th anniversary this year. Although a notable feat in itself, that since launch fundamental investment approach has remained stable and constant.

The Nordea 1 – European Value Fund, one of the first dedicated portfolios of its kind, celebrates its 25th anniversary this year. Although a notable feat in itself, that since launch fundamental investment approach has remained stable and constant.

This is a rarity in investment management today as great short-term performance pressures and increased style drift dominate the fund industry. Central to fund manager Stubbe Olsen’s investment process is a resolute focus on company fundamentals, while largely ignoring market and macro-economic noise. As the fund manager explains, he looks at prospective investments through the lens of a business owner, asking himself the simple question: Do I want to be a future owner of this business? “Fundamentally, we try to buy strong and dominant companies in their fields. These are companies which are able to create value and provide a return on invested capital. However, we only do this at a certain price. For us this is typically at a 40% discount to a company’s estimated fair value,” says Stubbe Olsen, fund manager.

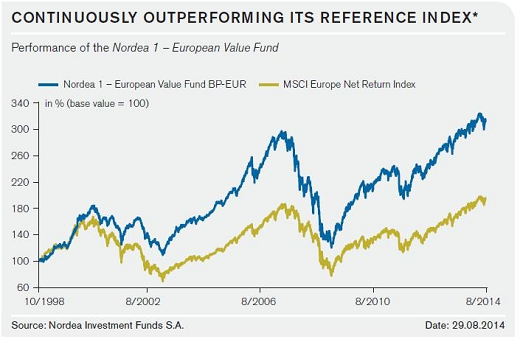

The key is to buy during the downturn and let the investments develop. That sounds very much like the mantra of the great Warren Buffett, who famously said: “Be fearful when others are greedy, and be greedy when others are fearful.” Best argument to prove this theory is Nordea 1 – European Value Fund performance itself.

DISCLAIMER

The information about investment services provided by Nordea and available in this website is of promotional nature. This information cannot be interpreted as a recommendation, instruction or an invitation to buy concrete financial instruments or to sell them and cannot be the basis or a part of any agreement made thereafter. Although this information was prepared on the grounds of sources that are considered to be reliable, Nordea is not responsible for any inaccuracies or losses suffered by investors who made use of that information. Information related to taxation is subject to change in the future and it may not suit you. The investment return is related to risks: the value of investments during the investment period can both decrease and increase. If the return earlier was positive, it may not be the same in the future. In some cases losses can exceed the value of initial investment. If you invest in financial instruments in foreign currency, the changes of the exchange rate can influence the investment return. You are responsible for your investment decisions; therefore, before making a decision you should get acquainted with all documents, prospects of funds and other prospects of financial instruments, The review of risks of investment into financial istruments, and information available on website: .

Making banking delightfully easy