New fiscal stimulus – boosting further rally or creating reasons for concern? | Luminor

New fiscal stimulus – boosting further rally or creating reasons for concern?

- Plans to introduce another $1.9 trillion fiscal stimulus in USA enhanced stock market participation and euphoria, which ironically contributed to market sell‑off in late January

- Additional government spending could support further rally in asset prices, but potential increase in taxes, public debt and speculative behavior may lead to unexpected negative outcomes

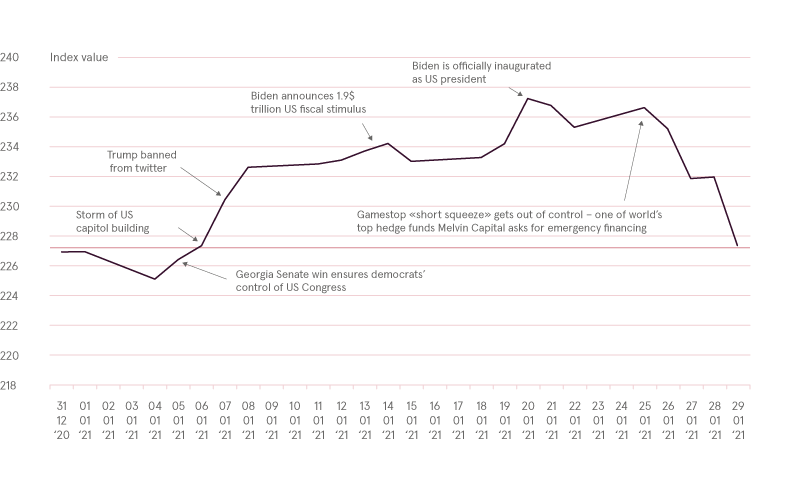

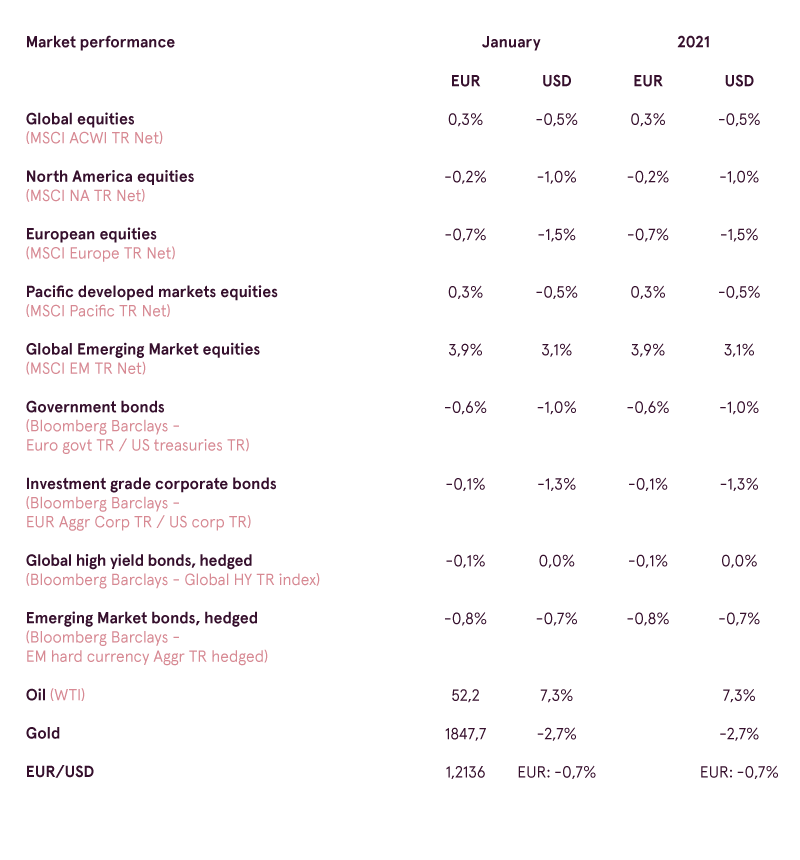

January 2021 was rather ambiguous month for equity markets. Start of the year happened on a positive note, as new fiscal stimulus measures, COVID‑19 vaccinations, decent corporate financial results and Joe Biden with democrats becoming in charge in USA continued to support rally from late 2020. However, last week of January crossed out early achievements, as unprecedented short squeeze in certain stocks made investors wary of potential vulnerabilities in already overbought market. As a result, most of global indices finished month relatively flat in terms of EUR based performance.

Performance of global equities (MSCI ACWI EUR index)

Source: Bloomberg

Speaking of positive developments for the markets, we mainly should note current political landscape in USA and plans of new fiscal stimulus. After Georgia Senate elections on January 5th, democrats in essence grabbed full control of US congress, and after 20th of January Joe Biden became new president in USA. Between these dates we witnessed rather awkward attempts by Donald Trump to block outcomes of elections, which resulted in storm of Congress building by some of Trump’s most radical supporters, Trump becoming banned from social platforms, and new impeachment trial launched by democrats. But, overall, financial markets did not give much credit to risks linked to Trump’s unwillingness to leave presidential office, and were more concerned on how next fiscal stimulus announced by Joe Biden may look like.

On 14th January or less than a month from previous $900 billion stimulus package passed in Congress, Joe Biden indeed announced intention to introduce another much larger stimulus bill now equal to $1.9 trillion and which also includes larger checks to population compared to what was distributed early this year ($1400 vs $600). To outside observer, such need to create much more government spending may look rather irresponsible, as it would make already record high US budget deficit even much larger. But on closer look, it becomes clear that, unfortunately, there are not many alternatives apart from additional government spending, how to avoid USA and thus World from entering another deep recession in current circumstances. Due to COVID‑19 restrictions large number of businesses would have already been either bankrupt or closed without funds received from the government, at the same time consumption levels would have already collapsed as unemployed and business owners would not have additional money available for spending or in worst cases to simply pay rent.

So the cause of new stimulus measures is rather noble for the economy and those people in need, however, this time around additional fiscal measures may not be so particularly beneficial for the financial markets or their stability. Key reasons come from the fact, that government spending needs to be financed and two ways how to do it is either to increase taxes or issue more government debt.

US budget balance as % of GDP

Source: Bloomberg

During election process democrats and Biden multiple times mentioned that if elected they might introduce higher corporate taxes and higher taxes for high net worth individuals. Now, given real need for additional sources of income and no potential obstacles from republicans, new legislation on higher taxes may indeed be introduced. As a result, it may lead to lower net profits of corporations and lower purchasing power of wealthy individuals in relation to their ability to acquire financial assets. Fundamentally speaking, for equities higher taxes are definitely negative.

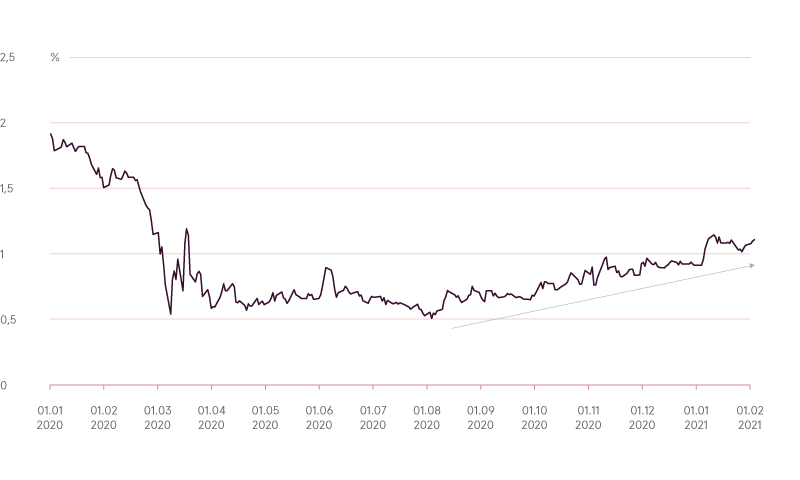

Alternatively, US government may finance all extra spending simply by issuing more public debt. In case such debt would be fully purchased by the FED, no major immediate negative consequences are likely to appear. Otherwise, it would increase supply of treasuries in the market, causing treasury yields to rise higher.

3 US 10‑year treasury yield

Source: Bloomberg

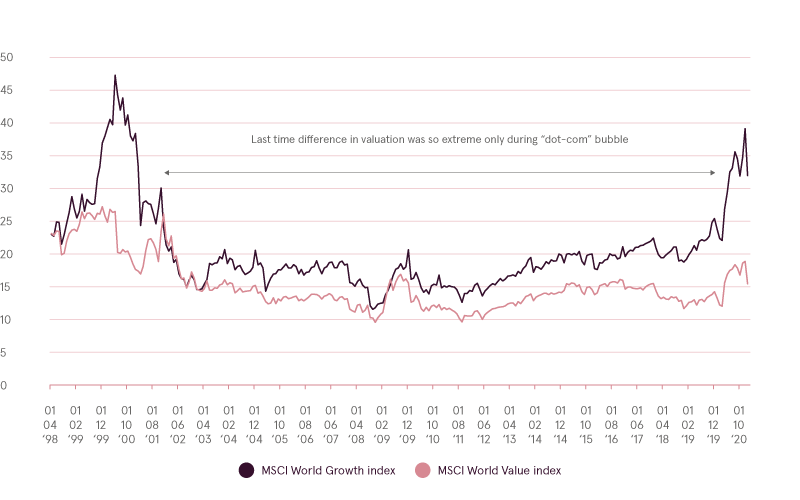

Higher bond yields obviously decrease prices of bonds, but may put negative pressure on equities as well. First of all, with higher yields bonds are able to generate higher return and become relatively more attractive for investment compared to already expensive equities. Secondly, and even more importantly in current market environment, higher bond yields increase discount rate used to value equities, especially hurting “growth” companies, which dominate equity indices at the moment, and especially so in USA1.

Forward P/E valuation metric of selected indices

Source: Bloomberg

There is however, one other reason, why too much fiscal stimulus may be dangerous for stability of financial markets, especially while COVID‑19 restrictions are still in place. This reason is creation of speculative impulses among population to trade in stocks with desire to make “a quick buck”. Two main factors influence such behavior. First of all, through checks and other fiscal stimulus measures, population (and even those, who are unemployed) is being provided with additional funds that they can spend or save. Secondly, by staying predominantly at home and having much more free time with fewer things to do, there is a tendency among people out of boredom to become more addicted to gambling2. Combination of these two factors makes people more and more interested in trading and investing, as it offers lucrative way how to use spare cash and create excitement in the process, especially when they hear stories of those who got earlier in the market last year and already realized solid gains.

So no surprise that with Biden plans of new stimulus, by the end of January speculative behavior of US population became truly euphoric. Such behavior can be visualized by certain financial ratios (e.g small trader calls bought to open), but it is way easier just to give you one simple fact. Most downloaded app in iPhone app store at the end of January in USA was free trading app Robinhood3. Not popular TikTok, Youtube, Facebook or some other social platforms, but application that allows you to trade fast and for free.

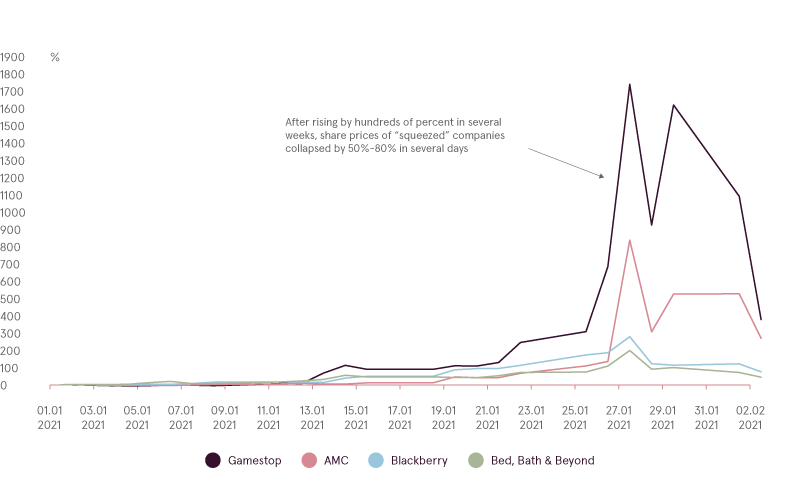

But many of these small traders entering the market went even step further. Through social platform Reddit, they decided to coordinate their trading efforts and make targeted purchases in selected companies. Key aim became beaten down stocks with high short interest, where professional hedge funds expect price of companies to decline (due to bankruptcy risks or some other considerations). And such coordination actually worked, especially so in company Gamestop, which in about two weeks increased by 2700% (!!!) due to massive short squeeze, as small traders in cooperation were actively buying, and hedge funds had to close their short positions in this idea and moreover liquidate some of their other purchased holdings to have enough liquidity to cover losses.

Short squeeze and its later unwind

Source: Bloomberg

Usually what happens in one or several not so large stocks is not so important for the whole market. However, when several billion companies start changing in price by 20‑100%+ in a day all at once, stability of financial markets may become vulnerable. That is why due to Gamestop saga, many successful hedge funds have already reported double digit losses in January, as they experienced unexpected losses, which were hardly imagined to happen before. In addition, already mentioned most popular broker Robinhood had to limit trading in the platform, and even ask its owners for extra capital, just because it became impossible to model risk on whether company has enough funds to obey regulatory financial requirements. Sell‑off in the markets in last week of January was largely influenced by these worries, as large investors decided to take some profits on abnormal volatility.

Hopefully, described events are just an outlier and will not be repeating going forward, but if euphoria will continue to remain high, we should not exclude that more and more assets with time would be driven not by fundamental investment related reasons, but purely by speculation.

Otherwise, moving into February key item to follow would be US policy decisions with fiscal package in main spotlight. In addition, hopefully, we will get more clarity on vaccinations and COVID‑19 trends. Due to some vaccine rollout delays, especially in Europe, by the end of January it was still too early to draw any conclusions on when lockdowns could be ended and life would return back to normal in most countries. February may change this situation, impacting markets as well.

1This impact is determined by the process called Discounted Cash Flow method, where to estimate fair value of equity all future cash flows of the company need to be discounted to present time. For “growth” companies, where largest proportion of future income would be generated only after many years, higher discount rate leads to more significant negative revision to present value.

2Some of the articles that describe such behavior in more detail can be found here:

Bloomberg.com: Bored Day Traders Locked at Home Are Now Obsessed With Options

Forbes.com: Researchers Find An Uptick In Trading Might Be Caused By Stay-At-Home Boredom

3Based on data collected by App Annie

Warnings:

- This Marketing Communication is not considered investment research and has not been prepared in accordance with standards applicable to independent investment research.

- This Marketing Communication does not limit or prohibit the bank or any of its employees from dealing prior to its dissemination.

Origin of the Marketing Communication

This Marketing Communication originates from Portfolio Management unit (hereinafter referred to as PMU) – a division of Luminor Bank AS (reg. No 11315936, with registered address at Liivalaia 45, 10145, Tallinn, Republic of Estonia, hereinafter - Luminor). PMU is involved in the provision of discretionary portfolio management services to Luminor clients.

Supervisory authority

As a credit institution Luminor is subject to supervision by the Estonian financial supervision and resolution authority (Finantsinspektsioon). Additionally, Luminor is subject to supervision by the European Central Bank (ECB), which undertakes such supervision within the Single Supervisory Mechanism (SSM), which consists of the ECB and the national responsible authorities (Council Regulation (EU) No 1024/2013 - SSM Regulation). Unless set out herein explicitly otherwise, references to legal norms refer to norms enacted by the Republic of Estonia.

Content and source of the publication

This Marketing Communication has been prepared by PMU for information purposes. Luminor will not consider recipients of this Communication as its clients and accepts no liability for use by them of the contents, which may not be suitable for their personal use.

Opinions of PMU may deviate from recommendations or opinions presented by the Luminor Markets unit. The reason may typically be the result of differing investment horizons, using specific methodologies, taking into consideration personal circumstances, applying a specific risk assessment, portfolio considerations or other factors. Opinions, price targets and calculations are based on one or more methods of valuation, for instance cash flow analysis, use of multiples, behavioural technical analyses of underlying market movements in combination with considerations of the market situation, interest rate forecasts, currency forecasts and investment horizon.

Luminor uses public sources that it believes to be reliable. However, Luminor has not performed independent verification. Luminor makes no guarantee, representation or warranty as to their accuracy or completeness. All investments entail a risk and may result in both profits and losses.

This Marketing Communication constitutes neither a solicitation of an offer nor a prospectus in the sense of applicable laws. An investment decision in respect of a financial instrument, a financial product or an investment (all hereinafter “product”) must be made on the basis of an approved, published prospectus or the complete documentation for such a product in question and not on the basis of this document. Neither this document nor any of its components shall form the basis for any kind of contract or commitment whatsoever. This document is not a substitute for the necessary advice on the purchase or sale of a financial instrument or a financial product.

No Advice

This Marketing Communication has been prepared by Luminor PMU as general information and shall not be construed as the sole basis for an investment decision. It is not intended as a personal recommendation of particular financial instruments or strategies. Luminor accepts no liability for the use of the Marketing Communication content by its recipients.

If this Marketing Communication contains recommendations, those recommendations shall not be considered as an objective or independent explanation of the matters discussed herein. This document does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the persons who receive it. The securities or other financial instruments discussed herein may not be suitable for all investors. The investor bears all risk of loss in connection with an investment. Luminor recommends that investors independently evaluate each issuer, security or instrument discussed herein and consult any independent advisors if they believe it necessary.

The information contained in this document also does not constitute advice on the tax consequences of making any particular investment decision. The estimates of costs and charges related to specific investment products are not provided therein. Each investor shall make his/her own appraisal of the tax and other financial advantages and disadvantages of his/her investment.

Risk information

The risk of investing in certain financial instruments, including those mentioned in this document, is generally high, as their market value is exposed to many different factors. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results. When investing in individual financial instruments the investor may lose all or part of their investments.

Important disclosures of risks regarding investment products and investment services are available here.

Conflicts of interest

To avoid occurrence of potential conflicts of interest as well as to manage personal account dealing and / or insider trading, the employees of Luminor are subject to the internal rules on sound ethical conduct, management of inside information, and handling of unpublished research material and personal account dealing. The internal rules have been prepared in accordance with applicable legislation and relevant industry standards. Luminor’s Remuneration Policy establishes no link between revenues from capital markets activity and remuneration of individual employees.

The availability of this Marketing Communication is not associated with the amount of executed transactions or volume thereof.

This material has been prepared following the Luminor Conflict of Interest Policy, which may be viewed here.

Distribution

This Marketing Communication may not be transmitted to, or distributed within, the United States of America or Canada or their respective territories or possessions, nor may it be distributed to any U.S. person or any person resident in Canada. The document may not be duplicated, reproduced and(or) distributed without Luminor’s prior written consent.