Lithuanian economy: fit and strong but challenges just around the corner

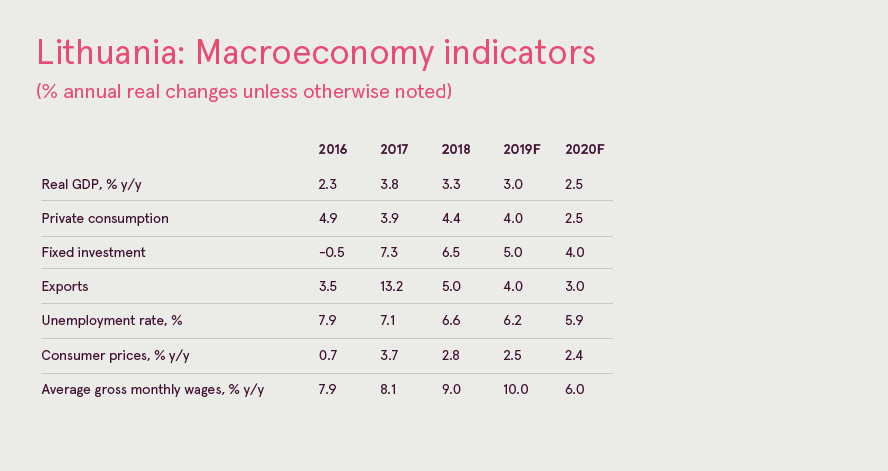

Lithuania is sticking to its recent success formula of economic development. The GDP growth is still driven by all variables: ongoing growth of household consumption, accelerating investments, and rising exports. The annual GDP growth accounted for 3.7% in the first half of the year and almost equalled to the excellent result of the year 2017 (3.8 %). However, the economic growth will moderate somewhat in the second half of the year due to slower export growth and poorer agricultural harvest (the sector is of particular significance in the third quarter). However the economic development will be further supported by domestically-oriented sectors enjoying robust demand growth.

Looking ahead Lithuania’s economic performance is expected to gradually loose momentum. In 2019-2020 it should expand by 3.3% and 2.5%. Domestic drivers should remain intact. Rising purchasing power and growing real wages should further fuel household consumption. Inflation after the shock last year is expected to settle down comfortably at sound 2.5%. In the meantime, earnings growth records seen this year could even be broken already next year. Given the record high capital utilization rates and labour shortages, investments should remain a very important growth pillar. Except for investments in real estate, which should be more modest due to weaker pulse of construction sector activities. Currently still strong exporters will keep following the development of Donald Trump’s trade wars with concern. They could breathe a sigh of relief only in case Europe managed to avoid getting caught in the cross-fire.

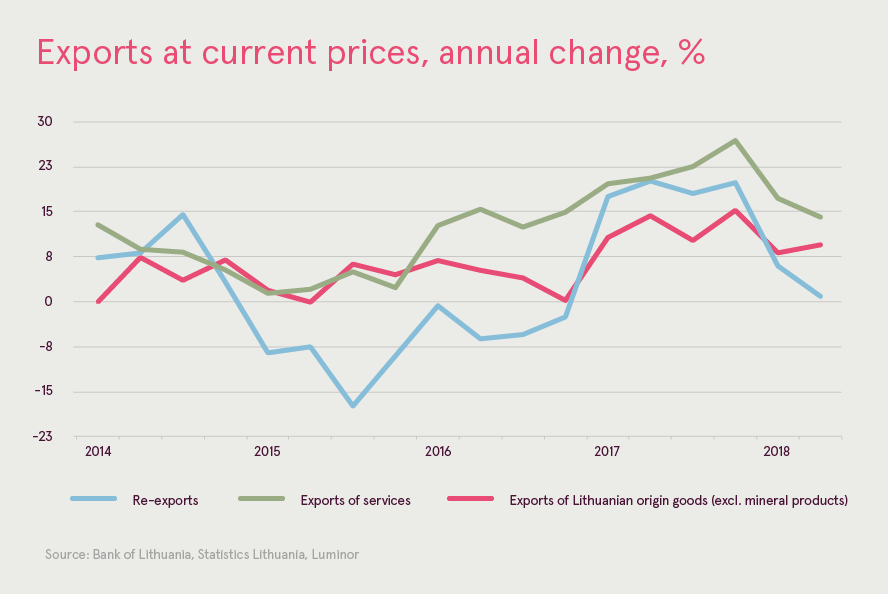

Exporters stay on course despite external headwinds

However, the increasingly uncertain external environment raises concerns about export growth sustainability. Protectionist rhetoric of the U.S. President Donald Trump is turning into actions directed towards China and other countries. The trade war brought in new variables that are hard to predict and can seriously disrupt the global economic situation and shake the economic confidence foundations which had been so carefully built by the central banks’ unprecedented expansionary measures. These trends already have a negative effect on the exporting sector’s business expectations in the EU, i.e. the main market for Lithuania.

Lithuanian exporters are so far resistant to the virus of increasing uncertainty. The growth rates of manufacturing demonstrate that our manufacturers do not lack orders so far, and business confidence indicator, which is the highest in post-crisis period, suggests that positive trend should keep its momentum in the nearest future. Paradoxically, Lithuania might even benefit from the accelerating global trade war. As member of the European Union, Eurozone, NATO, and OECD, Lithuania has come significantly closer to the leading western countries in terms of macroeconomic, business, and legal environment stability and the quality of infrastructure, while offering substantially cheaper labour. This comes as a significant competitive advantage against the developing markets like China, Turkey, Russia or Mexico, which stand in the front lines amid the trade and geopolitical tensions. These trends are also observed in other Central and Eastern European countries which will remain among the world’s fastest growing countries in the nearest future.

Investments to remain among the key growth cornerstones

These factors suggest that the investment ambitions should not change. The annual growth of gross fixed capital formation accounted for more than 9% over the past couple of quarters. It was driven by rapidly increasing construction sector, especially in the areas of the infrastructure and civil engineering. Both private and public investments will keep growing due to the EU structural support which is well under way. The productive investments in technological renewal should also remain on a similar level this year. Before the ECB changes the course of its monetary policy and as long as the money market conditions remain favourable, businesses should not change their investment behaviour. Renewing of manufacturing capacities is probably the only way to reduce the dependence on the increasingly expensive labour. That’s essential now, as the unemployment rate (seasonally adjusted) in Lithuania has been balancing on the level of 6.5 % for some time, pointing to extremely scarce labour reserve available. The unemployed are mainly those who are changing jobs or those whose qualification does not appear to be interesting to the labour market. The lack of labour is reflected by the increasing salaries in all spectre economic activities. The lack of qualified labour and wage growth at the fastest pace since the pre-crisis times still give a constant headache to many managers making them improve their business processes.

Consumers’ appetite is growing

The pulse of the domestic consumption remains exceptionally high. The real annual growth of retail trade turnover gathered the pace. It exceeded 7% in the second quarter this year. Good consumers’ appetite is well reflected by the European Commission’s consumer confidence index, which set the new record this spring since the year 2007. The economic upswing ensures the benign environment for further consumption growth: inflation tension slightly eased, labour market is humming from tension, salaries are expanding at double digit rate boosting purchasing power, favourable credit market conditions persist.. These conditions should not change in forecast horizon. While businesses are enjoying solid profits, investing in development or optimisation, the qualified labour shortage is more significant than ever. That will be forcing the employers to keep offering attractive salaries. Also, such circumstances as the year of elections, plans to increase the minimum monthly salary further and the government’s ambitions let us expect increasing salaries in the public sector too. All this promises a continuing upturn for many businesses feeding from the domestic market.

Lithuania has eventually reversed the migration trend

The significant improvement in Lithuania’s economic environment has lead to a turning point in the migration statistics this year. Statistics Lithuania has recorded a positive net migration for three months in a row, which means that more people are coming to Lithuania than leaving. These changes could in a way result from the limited possibilities to earn more in the Nordic countries due to slowing real estate market growth and from the uncertainty associated with Brexit. The United Kingdom is one of the main destinations for Lithuania’s emigrants, however the UK’s decision to exit the European Union raises huge uncertainties which could defer some of the potential emigrants from leaving or at least could make them postpone their trip. If this positive net migration became a long-term trend, it would be both an economic and mental victory for Lithuania. It would be one of the first proofs that we are becoming a centre of attraction, it would help resolve a serious problem of labour deficit, open new opportunities for the economic expansion, and help cure the greying complex of inferiority.

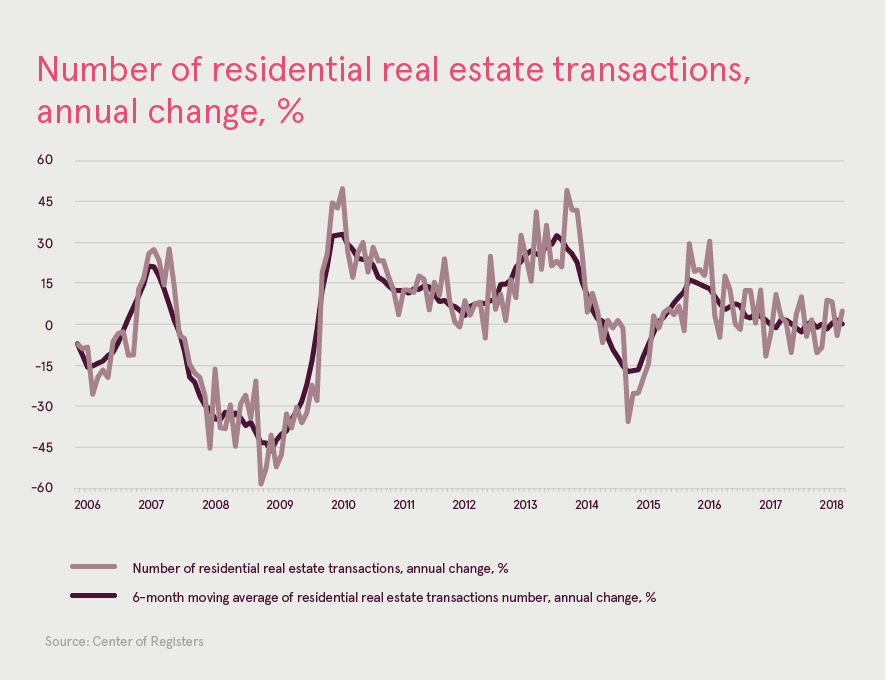

However, the sentiments in the real estate market is slightly different. The market growth has run out of steam, the activity has stabilised on the level reached in 2016-2017.The number of housing transactions made within seven months of this year did not change year-on-year. These trends are also grounded by the stabilised real estate prices (in some segments they are even slightly falling). In case the real estate market activity and prices started to shrink significantly, this would have a negative effect on the flourishing domestic consumption sectors related to construction and housing equipment. Anyway, with the healthy economic development and continuing low-interest environment, our base-case scenario remains stabilisation rather than a sharp correction. The stable growth of mortgage portfolios also indicates that housing is still in demand. Since mid-2017, the volumes of mortgage loans issued by banks keep growing by more than 8 % per year. Also, with the rapidly growing wages and increasing individual purchasing power, the housing affordability ratios remain historically high both in Vilnius and throughout Lithuania.

Inflation has run out of steam

In July, the annual inflation in Lithuania stood at 2.3 %, i.e. much lower than six months ago. In the context of the European Union, Lithuania has given its leading position to Romania, Bulgaria, Hungary, and Estonia for some time. In July, we went further down in the EU ranking, standing only 0.1 % above the EU average (2.2 %). However, in the future inflationary pressure will be supported by the imported factors. The food prices are expected to increase up as the grain harvest this season was degraded by the heat, while the oil market instability and rising prices also raise concerns. The growth of crud oil prices results from the decision of the oil-exporting countries to limit the supply, disruptions of oil exports from Venezuela, geopolitical tensions, Donald Trump’s decision to leave Iran nuclear deal, and re-instituted sanctions against the country.

The threat of procyclical fiscal behaviour looms in the eve of election marathon

The government proceeded implementing complex public sector reform in Lithuania this year. One significant part of all initiatives was the long-awaited tax system reform., which aimed to improve the country’s investment environment and reduce the labour tax burden. The Parliament approved to broaden the Tax Exempt Income (the TEI) application scope and join the social insurance contributions made by the employee and by the employer. As a result, from now the TEI and social insurance contribution tariffs will make 20% and 19% respectively. Moreover, it was decided to introduce a cap for social security contributions (Sodra). At the beginning they will make 120 average wages per year but will be gradually reduced. The progressive personal income tax tariff of 27% will be applied to income above the Sodra tax cap. These steps will eventually make the labour related effective tax rate the lowest in the Baltic States. We believe, that now it is the right time for structural changes like these: the solid economic growth and diminishing shadow economy guarantee increasing budget revenues, therefore no significant deviations from the fiscal discipline are expected. However, upcoming elections marathon in Lithuania is a greater threat to the fiscal sustainability than the tax reform. To strengthen their pre-election political capital, politicians increasingly come up with populist initiatives as a surprise to the public. But the pro-cyclic fiscal behaviour is not appropriate in the economic upswing phase. Now, on the contrary, financial reserves must be accumulated to prepare for a potential downturn in the future.

Source: Eurostat, Luminor

Žygimantas Mauricas

Chief Economist

Indrė Genytė-Pikčienė

Chief Analyst

Read more:

Making banking delightfully easy