Economic Outlook for Baltic countries – Running of the Bulls | Luminor

Estonia, Latvia and Lithuania as open economies benefit from a brisk cyclical upswing in global trade and growth.

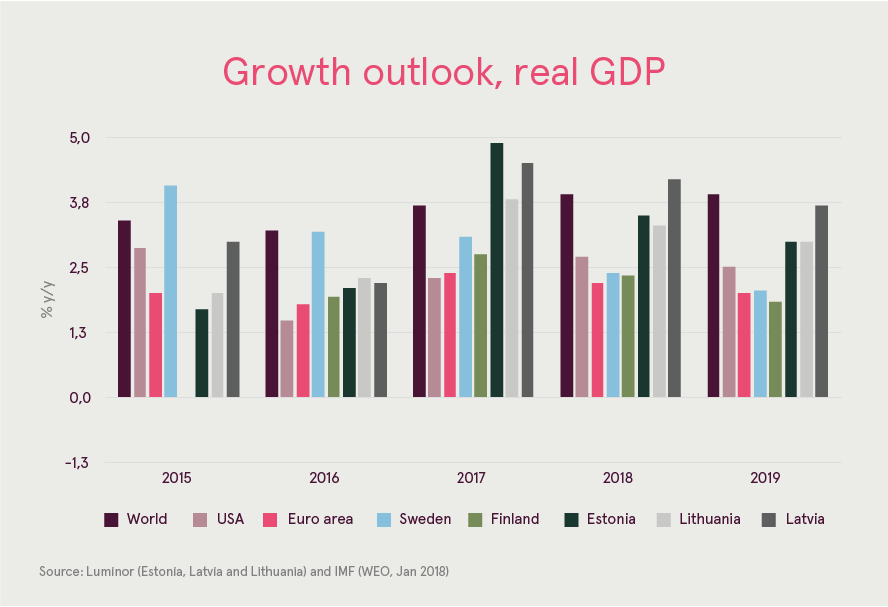

The latter is expected to accelerate to a 7-year high pace of 3.9 % y/y for both 2018 and 2019 according to the latest IMF World Economic Outlook from Jan 18. As a major shift the global recovery is now much more synchronized and entrenched across the countries, with the global business confidence at record high bolstering further prospects for domestic demand and improvements in labour markets.

On the background of brighter prospects for the global economic activity, growth forecasts have been upgraded across the board from the US, Euro area and Japan to many commodity producing countries. Soft data is pointing to a robust momentum continuing in the Euro area after a brisk 2.7% y/y (0.6% q-o-q) GDP boost exhibited again in Q4. Most notable, the global manufacturing upswing, which is feeding into Baltic industries export demand, is in full motion and complemented with a rise in employment and confidence. Furthermore, corporate revenues are today experiencing the new cyclical upswing, strengthening the outlook for investments. Notably, it’s foremost geopolitical tensions and political uncertainty risks which pose a potential downside for the overall bright prospects for the Baltic external demand outlook. In particular, Brexit has implications for Europe despite the stronger growth outlook. The UK direct exposure via trade links remains, however limited, for the Baltic countries. With regard to risks, trade tensions could also potentially taper record economic optimism and global trade.

Robust above-trend growth is on the cards for Baltic economies with the pace of expansion normalising from 2019 onwards. On the back of a favourable external backdrop, Estonia and Latvia delivered above 4 % growth rates last year (ca 4.9 % y/y and 4.5 % y/y respectively) with Lithuania posting robust 3.8 % y/y GDP expansion. Similarly to other Euro-area countries, the cyclical recovery has become more broad-based, with the key contribution to growth coming next year from domestic demand.

The new investment cycle has finally kick-started in the Baltic economies with investment levels low by historical standards. Fatter order books and rising capacity utilisation will drive industry investments into machinery and building structures. In terms of industry branches the expansion has took hold of food processing, transport and energy sectors, which have rebounded from subdued growth in the past years as demand and pricing power recovers. Furthermore, construction activity will benefit from favourable financing conditions and an accelerating flow of EU structural funds. The Baltic transport infrastructure will receive a significant contribution from the Rail Baltica rail transport infrastructure project, with a goal to integrate the Baltic States in the European rail network. The project has entered the design phase and is expected to be implemented by 2025-26.

Solid Euro-area growth of close to 2.3 % y/y supports above-potential growth in the Baltic countries in 2018, albeit at a slightly moderated speed due to base effects and as the expansion matures. Exports growth is expected to normalize from the initial strong boost and spans across goods and services with the faster pace experienced in the latter category. Constraints to growth are appearing first and foremost in the labour market with the growing lack of qualified labour.

Fundamentals for the Baltic economies remain strong, with public finances close to balance and government debt levels the lowest in the Euro area. The key future challenges for Estonia, Latvia and Lithuania are predominantly structural in nature and relate to challenges in accelerating productivity and value-added growth.

The Baltic countries will remain among the top fastest growing Euro-area countries, with a considerable income gap to be narrowed vis-à-vis European trading partners. During this long-term journey one should avoid temptations for excessive domestic stimulus. On the contrary, sustainable long-term growth rests upon hard choices like smart specialization, innovation and technological advance to boost export shares and margins. Enhancement of R&D spending in the private sector, bolstering of the SME and start-up ecosystem and most importantly investment in the human capital are examples of novel avenues to be exploited further to be able to reap the full benefits from the global technological and digital bulls race of the next decade. Revenues will continue to outperform in the globalizing technology industries.

Making banking delightfully easy