Secure online payment service

For the holders of Visa cards

In order to ensure safe online purchases with payment cards, Luminor has become a participant of the security program developed by international card organization „Visa“.

When paying online at the merchants branded with “Visa Secure” or “Verified by Visa” logo, you will be asked to confirm your identity. You can do that with the tools of secure authentication which you are using to log into Luminor Internet bank: Smart‑ID, m. signature or code generator.

This will help us to ensure that payment card is not used illegally, and your funds are safe.

How does the security program work?

- Before you start using your payment card for online purchases, you must enable Secure e‑purchase service on your Internet bank or Mobile bank.

If you are using business payment card, or payment card issued on another person’s account, the Secure e‑purchase service can only be enabled by the account owner.

NB! You, as a holder of the card, must have an Internet bank agreement with Luminor and must be able to log into Internet bank with one of the secure authentication tools. - While making a purchase at merchant branded with “Visa Secure” or “Verified by Visa”) logo, enter your payment card details.

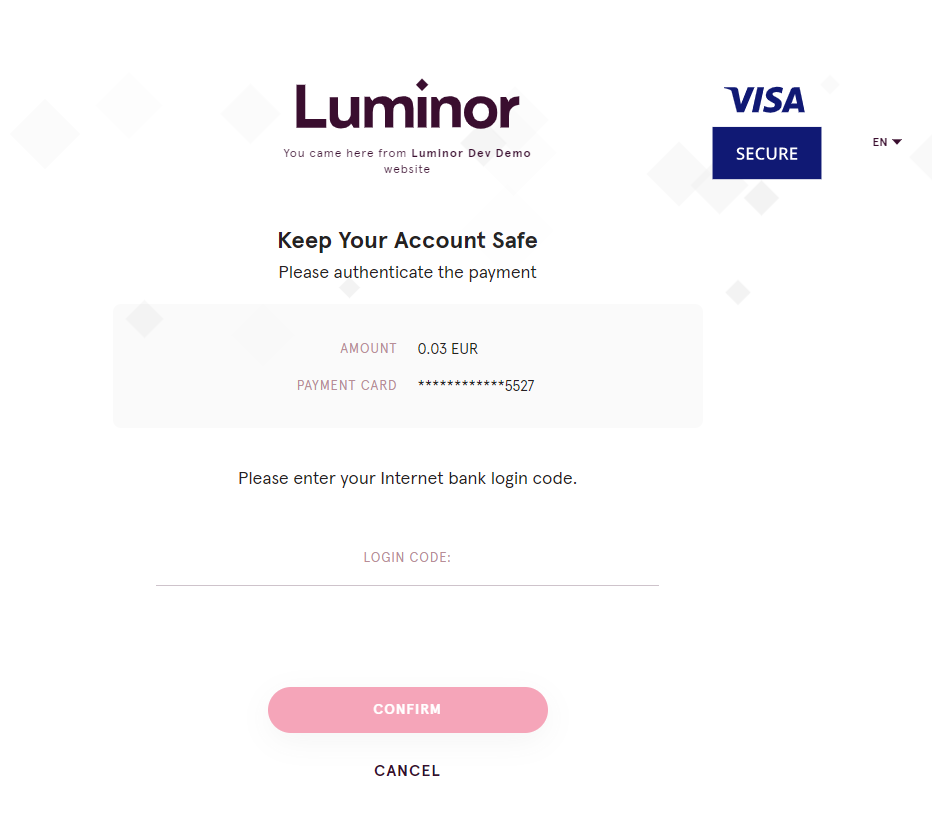

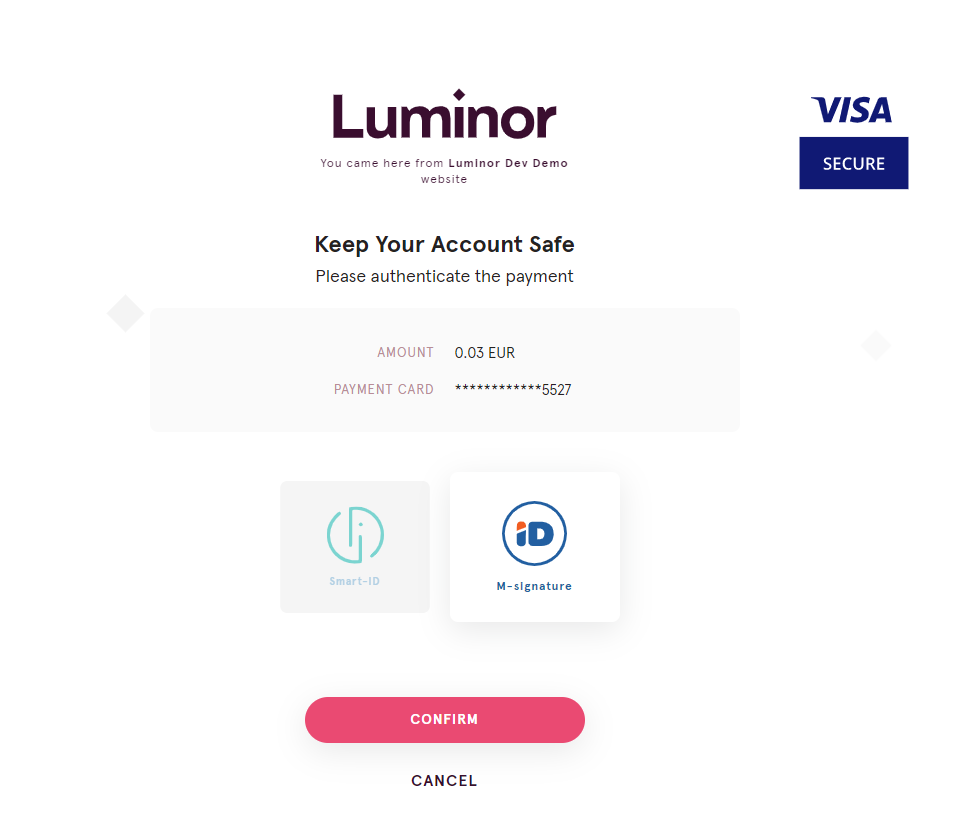

- Shortly you will see Luminor secure e‑purchase window with all the details about purchase and information how to proceed with confirming your identity and complete payment for goods or services.

- You could also be asked to enter your Luminor Internet bank login code.

- To confirm your identity, you must use only those tools of secure authentication which you are using to log into Internet bank.

- After successful confirmation of the identity, purchase is completed. Usually after it you will be redirected back to the merchant’s webpage.

Worth knowing

- If you are not planning to use your payment card for online purchases, we advise you to leave Secure e‑purchase service disabled.

- Before you confirm your identity make sure that the information you see on Luminor secure e‑purchase window is correct.

- If we detect unusual, suspicious or possibly illegal behavior during the process of identity confirmation, we will restrict the access to the Internet bank account of the cardholder. That is to ensure that payment card is not used illegally, and your funds are safe. Always be sure that you enter correct PIN code (Smart‑ID or m. signature application) or code generator’s code.

- If the purchase is being done at the online merchant which is not participant of the secure program developed by “Visa”, the payment will be completed without authentication step.

Frequently Asked Questions

It is mandatory to have Luminor Internet bank account and a valid authentication tool, which could be used to login into Internet bank: Smart‑ID, m. signature or code generator.

Also make sure you have Secure e‑purchase service enabled.

You can do this by coming to the customer service center (you should have your personal identity document – passport or identity card).

Internet bank: Payment Cards → E-Purchase settings → Activate service.

Mobile bank: Cards → Secure e-purchase status.?

All payment cards branded with “Visa” logo are subjects to the changes.

Check whether cookies and pop-up windows are enabled in your browser.

Identity authentication during the purchase usually is required when payment is done at the merchant which is participant of “Visa” developed security program.

It usually is branded with “Visa Secure” or “Verified by Visa” logo.

If merchant is not a participant of security program, payment is completed without additional authentication step.

Make sure that:

- You have access to Luminor Internet bank.

- Your Internet bank account or authentication method you are using is not restricted/blocked. Usually the information about applied restrictions could be seen on purchase authentication window or on your phone (Smart-ID or m. signature application).

- Your card is active and valid.

- You have enabled Secure e-purchase service for your payment card.

If none of the above is the reason for not being able to confirm the purchase, please contact us via phone +370 5 239 3444.

In order to protect customer‘s funds and the means of payment from illegal use, Internet bank account might be restricted if authentication data is entered incorrectly. Also Internet bank account could be restricted if authentication was not completed few times in a row.

Always make sure that you confirm your identity with the secure authentication tool which you are using to log into Luminor Internet bank. Always be sure that you enter correct PIN code (Smart-ID or m. Signature application) or correct code generator’s code.

No, he/she can authenticate a purchase with payment card online using already owned access to company’s Internet bank. If cardholder is aware that his/hers Internet bank access might be terminated, but he/she intends to use his/her business card, it is mandatory to conclude a new Internet bank agreement with Luminor as an individual.

It is forbidden to pass usage of the payment card to the person who is not the rightful owner of the card (card is issued not on the name of that person). In order to pay, it is needed to order new card on the name of the new cardholder.

Luminor in parallel is supporting older and updated versions of „Visa“ security program protocols. User interface design of authentication application is dependent on which protocol of security program will be used in the process.

Which protocol will be used in the process of authentication will be dependent on the version the merchant, at which payments is being made,

New „Visa“ security program protocol version user interface design looks like in the examples: