Markets bounced back to all-time highs | Luminor

Markets bounced back to all-time highs

- Markets recovered from a minor correction

- Inflation expectations reached new highs

- High probability of a year-end rally

Mild correction, which took place in September, was widely expected, as 5% corrections in the S&P 500 index typically occur three to four times a year, larger corrections of more than 15% happens on average once per two years. Yet, investors have not seen a 10-20% correction in the S&P 500 index already for more than 400 days.

Looking on the bright side, the 4th quarter is typically known in the markets as a year-end or “Santa Claus” rally period, as profits are boosted by increased spending in order to prepare for Christmas and New Year. According to the US National Retail Federation’s (NRF) forecast, sales growth in November-December this year are expected to hit record levels, reaching 8.5-10.5%, as major consumer goods makers and retailers work hard to prevent supply chain disruptions and avoid empty shelves during the gift season. Thanks to the rising incomes and stronger than ever household savings, consumers are expected to spend more on goods, while rising inflation will contribute to higher spending value.

After the brief pullback in September, markets rebounded sharply and many equity indexes reached new record highs. Investors’ willingness to “buy the dip” was lifted by strong corporate earnings during the third quarter. Moreover, concerns about the Chinese real estate market meltdown subsided after the local central bank assured, that it can contain risks, which are rising from the troubled real estate developer Evergrande. Local authorities also pressured the founder of Evergrande, billionaire Hui Ka Yan, to use his personal wealth to pay off the company’s debt. This fact demonstrates the unwillingness of the Chinese government to rescue the company and its continuous crackdown on the upper class. It is unclear, whether Hui Ka Yan’s assets could make a dent in the Evergrande’s 300 billion USD debt.

During October, many companies started to announce their third quarter results, which in many cases were better than anticipated. At the time of making this overview, 363 out of 500 S&P 500 index companies reported their results, according to Bloomberg LP data. On average, these companies announced that third quarter sales grew almost 18.5% (Q/Q), while earnings increased roughly 39.4% (Q/Q). In Europe, earnings were also strong – 272 out of 442 Euro Stoxx 600 index companies reported 14% (Q/Q) sales growth and 51.4% (Q/Q) earnings growth.

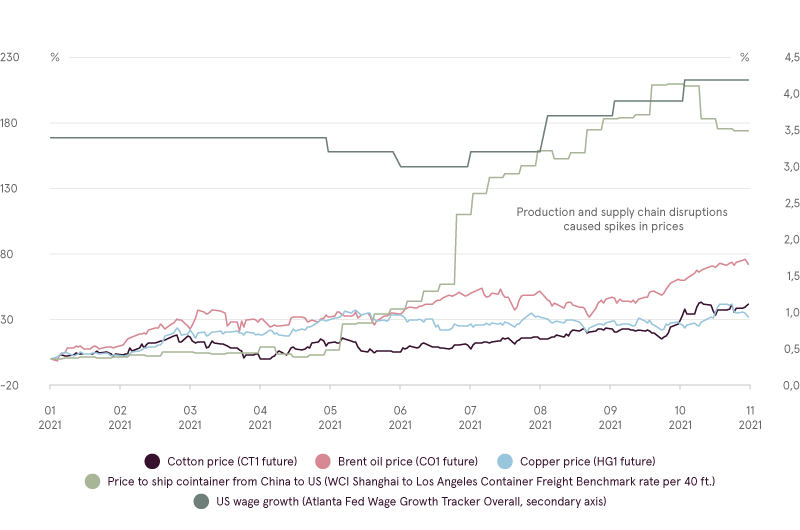

Commodities, wage growth and supply chain bottlenecks

Source: Bloomberg LP

Rallies in oil prices and other commodities added to inflationary pressures, while wage growth in the US was reaching highest levels in more than a decade. Regardless of recurring statements by central banks, that the rise of products and services prices is transitionary and will ease in 2022, central banks could be forced to start raising interest rates sooner than expected, if inflation continues to overshoot.

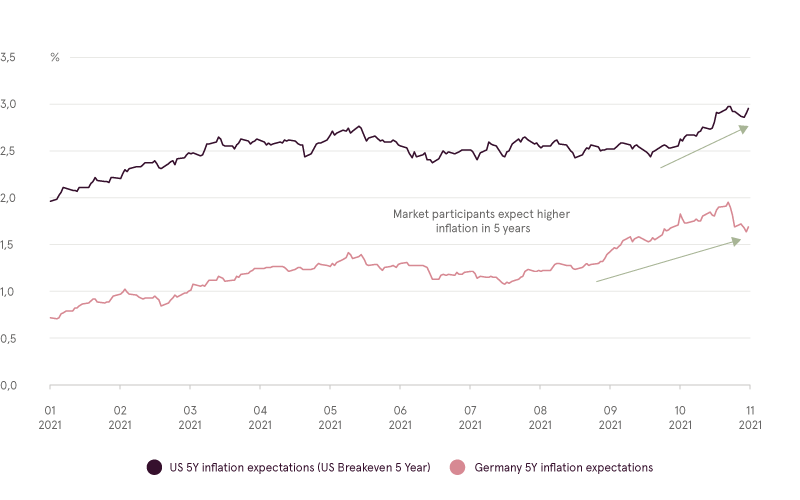

It seems, that market participants started to lose faith in the transitory inflation narrative. This can be clearly seen in the US 5-year inflation expectations1, which reached 16-year highs last month. Higher than expected inflation opinion is supported by producers of consumer staples like Unilever. The company’s finance chief told that they expect inflation to be higher next year than in 2021. Unilever makes fast-moving consumer goods, such as soaps, detergents, food products, etc. One of the biggest food makers Nestle announced that they plan to increase product prices as prices of raw materials keep on climbing. It is not yet clear, which scenario is more probable. In the case of a swift recovery of the global supply chains, shortages would disappear and inflation would diminish to normal levels. For instance, freight rates from Shanghai to Los Angeles seem to have reached an interim peak and corrected slightly. On the other hand, if high inflation rates persist and central banks start to tighten monetary policy, higher interest rates could trigger re-evaluation of risky assets.

5Y inflation expectations

Source: Bloomberg LP

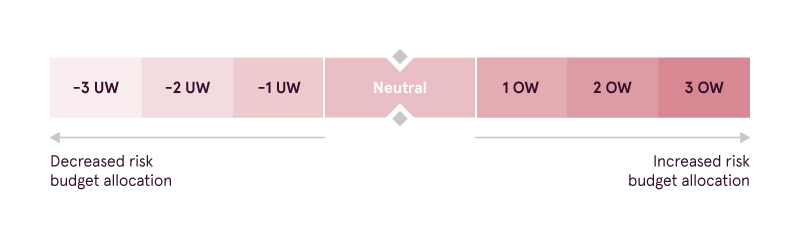

“House view” update

During the correction and rebound phase, we remained at Neutral risk allocation. Most indicators and models, which deteriorated during the pullback in the markets, rebounded nicely, but still, they did not warrant going overweight just yet. There is a high probability, that optimism will continue to push indexes higher until the end of the year, as we enter seasonally good period. We are continuously assessing the situation in the markets and will make adjustments if needed.

15 year inflation expectation rate is calculated by subtracting the real yield of the inflation linked maturity curve from the yield of the closest nominal Treasury maturity.

Warnings:

- This Marketing Communication is not considered investment research and has not been prepared in accordance with standards applicable to independent investment research.

- This Marketing Communication does not limit or prohibit the bank or any of its employees from dealing prior to its dissemination.

Origin of the Marketing Communication

This Marketing Communication originates from Portfolio Management unit (hereinafter referred to as PMU) – a division of Luminor Bank AS (reg. No 11315936, with registered address at Liivalaia 45, 10145, Tallinn, Republic of Estonia, hereinafter - Luminor). PMU is involved in the provision of discretionary portfolio management services to Luminor clients.

Supervisory authority

As a credit institution Luminor is subject to supervision by the Estonian financial supervision and resolution authority (Finantsinspektsioon). Additionally, Luminor is subject to supervision by the European Central Bank (ECB), which undertakes such supervision within the Single Supervisory Mechanism (SSM), which consists of the ECB and the national responsible authorities (Council Regulation (EU) No 1024/2013 - SSM Regulation). Unless set out herein explicitly otherwise, references to legal norms refer to norms enacted by the Republic of Estonia.

Content and source of the publication

This Marketing Communication has been prepared by PMU for information purposes. Luminor will not consider recipients of this Communication as its clients and accepts no liability for use by them of the contents, which may not be suitable for their personal use.

Opinions of PMU may deviate from recommendations or opinions presented by the Luminor Markets unit. The reason may typically be the result of differing investment horizons, using specific methodologies, taking into consideration personal circumstances, applying a specific risk assessment, portfolio considerations or other factors. Opinions, price targets and calculations are based on one or more methods of valuation, for instance cash flow analysis, use of multiples, behavioural technical analyses of underlying market movements in combination with considerations of the market situation, interest rate forecasts, currency forecasts and investment horizon.

Luminor uses public sources that it believes to be reliable. However, Luminor has not performed independent verification. Luminor makes no guarantee, representation or warranty as to their accuracy or completeness. All investments entail a risk and may result in both profits and losses.

This Marketing Communication constitutes neither a solicitation of an offer nor a prospectus in the sense of applicable laws. An investment decision in respect of a financial instrument, a financial product or an investment (all hereinafter “product”) must be made on the basis of an approved, published prospectus or the complete documentation for such a product in question and not on the basis of this document. Neither this document nor any of its components shall form the basis for any kind of contract or commitment whatsoever. This document is not a substitute for the necessary advice on the purchase or sale of a financial instrument or a financial product.

No Advice

This Marketing Communication has been prepared by Luminor PMU as general information and shall not be construed as the sole basis for an investment decision. It is not intended as a personal recommendation of particular financial instruments or strategies. Luminor accepts no liability for the use of the Marketing Communication content by its recipients.

If this Marketing Communication contains recommendations, those recommendations shall not be considered as an objective or independent explanation of the matters discussed herein. This document does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the persons who receive it. The securities or other financial instruments discussed herein may not be suitable for all investors. The investor bears all risk of loss in connection with an investment. Luminor recommends that investors independently evaluate each issuer, security or instrument discussed herein and consult any independent advisors if they believe it necessary.

The information contained in this document also does not constitute advice on the tax consequences of making any particular investment decision. The estimates of costs and charges related to specific investment products are not provided therein. Each investor shall make his/her own appraisal of the tax and other financial advantages and disadvantages of his/her investment.

Risk information

The risk of investing in certain financial instruments, including those mentioned in this document, is generally high, as their market value is exposed to many different factors. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results. When investing in individual financial instruments the investor may lose all or part of their investments.

Important disclosures of risks regarding investment products and investment services are available here.

Conflicts of interest

To avoid occurrence of potential conflicts of interest as well as to manage personal account dealing and / or insider trading, the employees of Luminor are subject to the internal rules on sound ethical conduct, management of inside information, and handling of unpublished research material and personal account dealing. The internal rules have been prepared in accordance with applicable legislation and relevant industry standards. Luminor’s Remuneration Policy establishes no link between revenues from capital markets activity and remuneration of individual employees.

The availability of this Marketing Communication is not associated with the amount of executed transactions or volume thereof.

This material has been prepared following the Luminor Conflict of Interest Policy, which may be viewed here.

Distribution

This Marketing Communication may not be transmitted to, or distributed within, the United States of America or Canada or their respective territories or possessions, nor may it be distributed to any U.S. person or any person resident in Canada. The document may not be duplicated, reproduced and(or) distributed without Luminor’s prior written consent.