Consistent market patterns year to date, should we expect more of the same in April? | Luminor

Consistent market patterns year to date, should we expect more of the same in April?

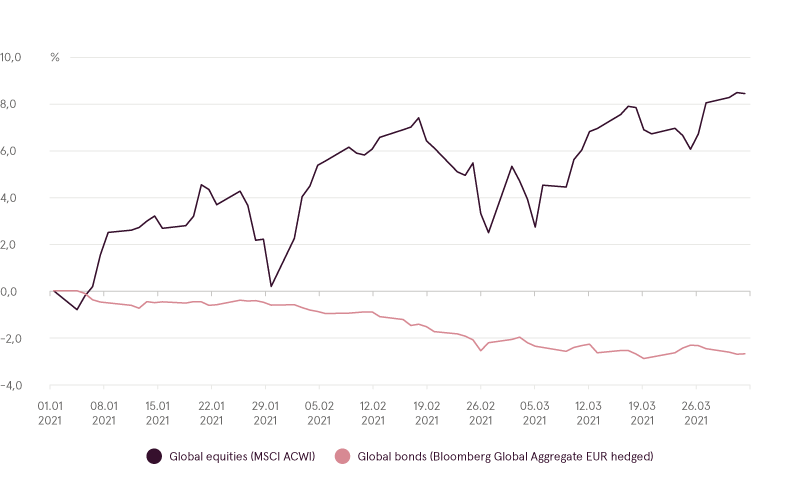

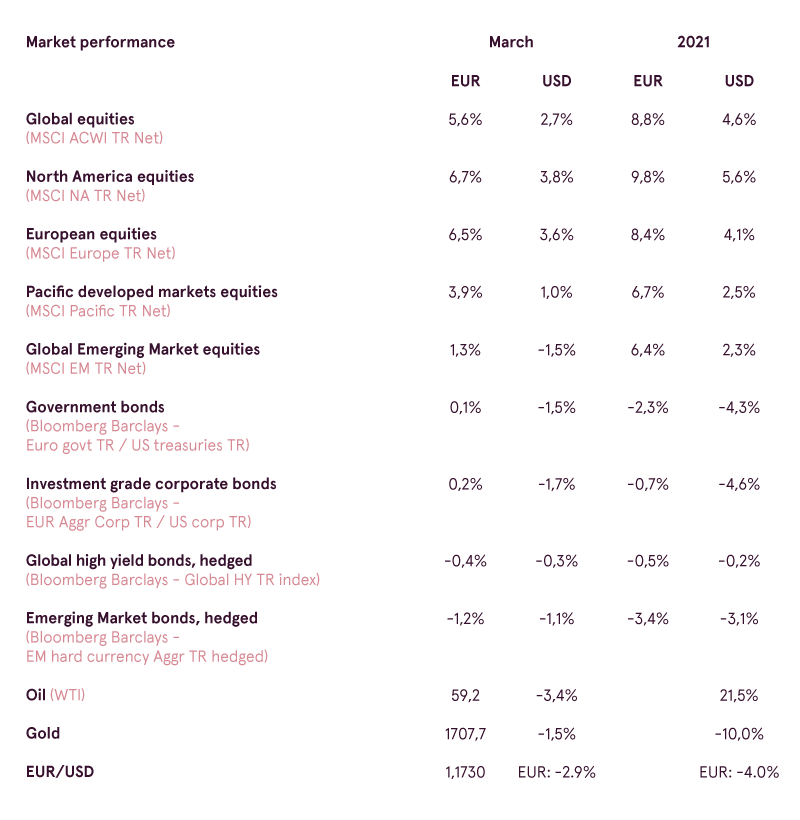

- Equity indices continued to shine in March, meanwhile global bonds are still pressured by fears of rising inflation and excess public debt;

- With more stimulus measures and post‑COVID global reopening on the horizon, path of least resistance in equities is likely to remain up, though isolated cases of extreme risk in certain stocks warrant caution.

Price movements of financial assets in March continued to resemble tendencies observed since the beginning of the year – relatively choppy rise in global equities and rather steady decline in global bonds. Key reasons for such developments also practically continued to be the same – unprecedented fiscal stimulus in USA with plans of even more government spending going forward together with ongoing COVID related implications for the global economy (e.g. threat of rising inflation).

YTD performance of major asset classes

Source: Bloomberg

In mid‑March US congress finally approved another round of additional government spending amounting to $1.9 trillion. Similar to previous occasions, this time fiscal measures once again included stimulus checks with payments of up to $1400 per individual. As we already mentioned in previous reports, such checks tend to benefit economy both through extra spending made by population and their ability to use part of these funds for extra savings (i.e purchase of financial assets, mostly equities). These new measures were already expected since January and were moving markets higher since the beginning of the year, so it can be argued that by March large part of this news was already priced in.

Therefore, to keep optimistic momentum going, almost immediately after new stimulus bill was passed, Biden administration started to hint at yet another spending plan. And indeed, at the end of March additional $2 trillion infrastructure plan was announced. So far equity markets continue to react positively to this announcement, as new plan would almost certainly be beneficial for the economy and would help certain companies to increase financial results. However, at closer examination, this time market participants should probably not get too excited. First of all, it would not happen immediately as was the case with previous stimulus measures, but over the course of 8 to 10 years, and also it would be almost fully financed by higher corporate taxes. So while some companies might gain from additional infrastructure orders, profits of most companies would likely be hurt by necessity to pay higher taxes.

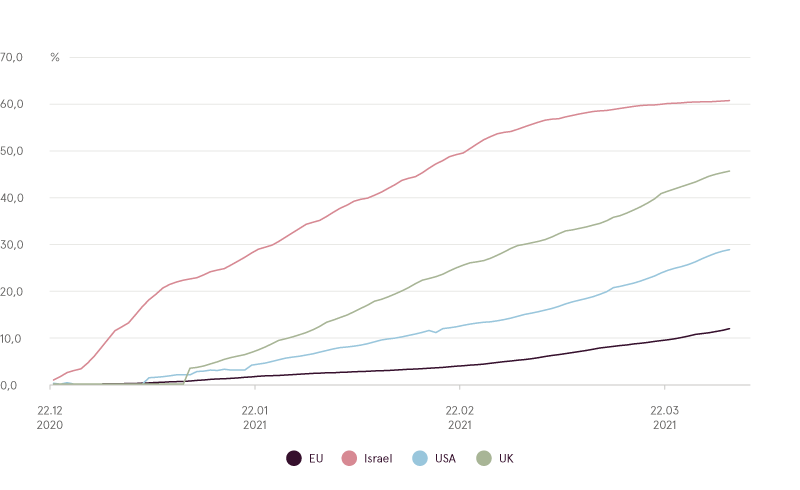

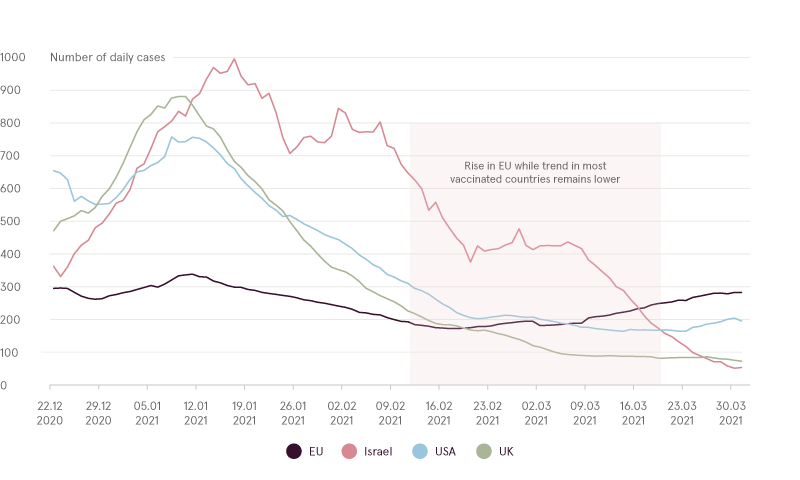

Another reason for short‑term optimism was related to COVID‑19 trends. Countries like USA, UK and Israel continue to implement large scale vaccinations of population and number of new virus cases in these countries is on a steady decline. It proves that vaccinations are indeed effective and full reopening of the economies is just a matter of time. However, for some regions, specifically in Europe situation is actually becoming not better, but worse. In EU number of new cases was constantly rising throughout March, indicating start of so called “third wave” in cases, and causing delays to initial plans to terminate lockdowns as early as April. Reason for such development in Europe is actually quite simple – vaccination process is happening at much slower pace, and only around 10‑20% of population received their first dose, which is not enough to prevent rise in COVID‑19 spread. But hopefully, situation would start changing for the better in April.

Percentage of population vaccinated

Source: ourworldindata.org

New daily COVID-19 cases per million

Source: ourworldindata.org

However, while equity markets looked relatively calm and positive on the surface, with fluctuations in indices being relatively small and contained, price changes in certain well‑known and popular stocks continued to remain extremely volatile since February. These stocks have pronounced high‑growth characteristics, extremely high valuation multiples and were among the very best performers since 2020 bottom (rising by 500‑1000%). Such equities include names like Tesla, Zoom, Paypal, Shopify, Snapchat, Pinterest, Farfetch and dozens of other less known companies. In a period of about one month these companies lost in value in the range from 30% to 50%, which is on par to how equities were behaving during last March COVID crash. We explained reasons in more detail in previous market updates, but to repeat it briefly - threats of higher global inflation and increase in US public debt continue to push bond yields higher. As long‑term cost of capital is being increased, investors are forced to reevaluate and downgrade fair value of high‑flying stocks as well, as most of their income would be generated far into the future.

YTD maximum drawdown of selected high growth stocks

Source: Bloomberg

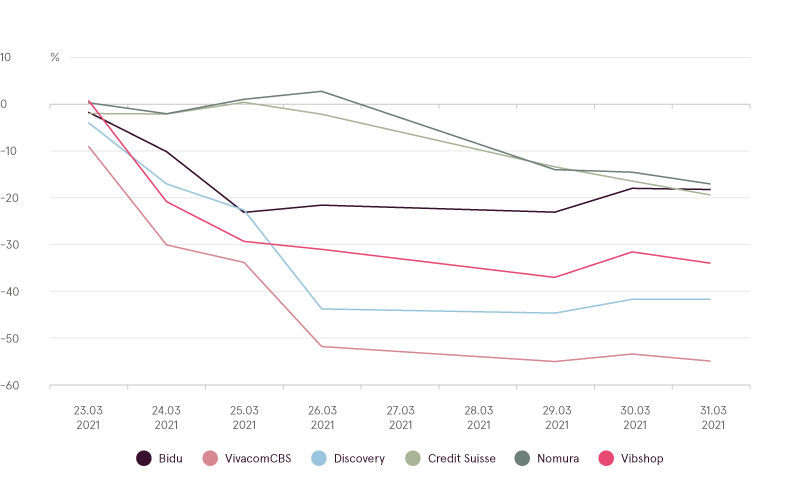

Moreover, in late March another risk‑off event has happened. For reasons not yet fully known, but overleveraged hedge fund Archegos went bust. Company took too much debt, as its total size of positions was estimated to reach more than $100 billion, but funded only by $10‑20 billion in capital. As a result, unfavorable price changes caused hedge fund to default, triggering multibillion forced liquidations in its holdings such as Bidu, ViacomCBS, Discovery and several others, leading these stocks to lose up to 60% in price in the matter of several trading days. But damage was not only through these holdings, Archegos default on margin calls led its counterparties such as Credit Suisse and Nomura to announce that their losses might also constitute several USD billions, causing share prices of both to fall by ~15% just in one day, meanwhile making Archegos one of the largest asset management collapses in history.

Performance of key Archegos impacted companies

Source: Bloomberg

These events vividly illustrate that in current environment risk may happen incredibly fast, and therefore focus on risk management should probably prevail over attempts to generate extra profits. So far we are seeing only isolated cases of extreme risks (apart from abovementioned occasions, let us remember January GameStop “short squeeze” and retaliatory measures to limit trading undertaken by financial brokers in order not to destabilize financial system). But in the current environment dominated by euphoria there is no certainty that even larger risk events (“Black swans”) would not happen over time.

Otherwise, excluding low chance of unpredictable risk events, April appears to be yet another promising month for generating higher equity returns. Investors would likely continue look forward to global economic reopening and return of robust economic growth in the world post‑COVID‑19. Fiscal stimulus funds would continue to influx into economy and financial markets, and central banks would continue to implement monetary easing with no plans in sight of any tightening. Certain negative pressures might show up due to tax considerations. First of all, April is deadline to pay capital gains tax, and lots of new investors may actually sell some of their existing holdings to fund these costs. Secondly, US government may announce further plans to introduce higher taxes not just for corporations, but also for wealthiest individuals. But on balance the path of least resistance still remains upwards.

Warnings:

- This Marketing Communication is not considered investment research and has not been prepared in accordance with standards applicable to independent investment research.

- This Marketing Communication does not limit or prohibit the bank or any of its employees from dealing prior to its dissemination.

Origin of the Marketing Communication

This Marketing Communication originates from Portfolio Management unit (hereinafter referred to as PMU) – a division of Luminor Bank AS (reg. No 11315936, with registered address at Liivalaia 45, 10145, Tallinn, Republic of Estonia, hereinafter - Luminor). PMU is involved in the provision of discretionary portfolio management services to Luminor clients.

Supervisory authority

As a credit institution Luminor is subject to supervision by the Estonian financial supervision and resolution authority (Finantsinspektsioon). Additionally, Luminor is subject to supervision by the European Central Bank (ECB), which undertakes such supervision within the Single Supervisory Mechanism (SSM), which consists of the ECB and the national responsible authorities (Council Regulation (EU) No 1024/2013 - SSM Regulation). Unless set out herein explicitly otherwise, references to legal norms refer to norms enacted by the Republic of Estonia.

Content and source of the publication

This Marketing Communication has been prepared by PMU for information purposes. Luminor will not consider recipients of this Communication as its clients and accepts no liability for use by them of the contents, which may not be suitable for their personal use.

Opinions of PMU may deviate from recommendations or opinions presented by the Luminor Markets unit. The reason may typically be the result of differing investment horizons, using specific methodologies, taking into consideration personal circumstances, applying a specific risk assessment, portfolio considerations or other factors. Opinions, price targets and calculations are based on one or more methods of valuation, for instance cash flow analysis, use of multiples, behavioural technical analyses of underlying market movements in combination with considerations of the market situation, interest rate forecasts, currency forecasts and investment horizon.

Luminor uses public sources that it believes to be reliable. However, Luminor has not performed independent verification. Luminor makes no guarantee, representation or warranty as to their accuracy or completeness. All investments entail a risk and may result in both profits and losses.

This Marketing Communication constitutes neither a solicitation of an offer nor a prospectus in the sense of applicable laws. An investment decision in respect of a financial instrument, a financial product or an investment (all hereinafter “product”) must be made on the basis of an approved, published prospectus or the complete documentation for such a product in question and not on the basis of this document. Neither this document nor any of its components shall form the basis for any kind of contract or commitment whatsoever. This document is not a substitute for the necessary advice on the purchase or sale of a financial instrument or a financial product.

No Advice

This Marketing Communication has been prepared by Luminor PMU as general information and shall not be construed as the sole basis for an investment decision. It is not intended as a personal recommendation of particular financial instruments or strategies. Luminor accepts no liability for the use of the Marketing Communication content by its recipients.

If this Marketing Communication contains recommendations, those recommendations shall not be considered as an objective or independent explanation of the matters discussed herein. This document does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the persons who receive it. The securities or other financial instruments discussed herein may not be suitable for all investors. The investor bears all risk of loss in connection with an investment. Luminor recommends that investors independently evaluate each issuer, security or instrument discussed herein and consult any independent advisors if they believe it necessary.

The information contained in this document also does not constitute advice on the tax consequences of making any particular investment decision. The estimates of costs and charges related to specific investment products are not provided therein. Each investor shall make his/her own appraisal of the tax and other financial advantages and disadvantages of his/her investment.

Risk information

The risk of investing in certain financial instruments, including those mentioned in this document, is generally high, as their market value is exposed to many different factors. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results. When investing in individual financial instruments the investor may lose all or part of their investments.

Important disclosures of risks regarding investment products and investment services are available here.

Conflicts of interest

To avoid occurrence of potential conflicts of interest as well as to manage personal account dealing and / or insider trading, the employees of Luminor are subject to the internal rules on sound ethical conduct, management of inside information, and handling of unpublished research material and personal account dealing. The internal rules have been prepared in accordance with applicable legislation and relevant industry standards. Luminor’s Remuneration Policy establishes no link between revenues from capital markets activity and remuneration of individual employees.

The availability of this Marketing Communication is not associated with the amount of executed transactions or volume thereof.

This material has been prepared following the Luminor Conflict of Interest Policy, which may be viewed here.

Distribution

This Marketing Communication may not be transmitted to, or distributed within, the United States of America or Canada or their respective territories or possessions, nor may it be distributed to any U.S. person or any person resident in Canada. The document may not be duplicated, reproduced and(or) distributed without Luminor’s prior written consent.