Interest rates | Luminor

Interest rates

- The new housing variable interest rate loans can be granted by applying a variable interest rate that consists of a 3, 6, or 12-month Euribor (European Interbank Offered Rate) + individual interest margin.

- Euribor is determined, administered, and published by the European Money Markets Institute (EMMI)

- The ratio reflects a short-term borrowing rate in the market. If the EURIBOR is negative, it is considered to be zero.

- The variable interest rate may vary depending on the situation in the market, i.e. due to the changes in the Euribor, the interest rate may go up or down.

- The interest margin is calculated on an individual basis and is set taking into account the customer‘s credit history, the purpose of a credit, the extent of cooperation with the bank, the liquidity of a real estate pledged, etc.

Housing loans can be granted by applying a fixed interest rate that may be set for a period of up to 5 years but no less than 12 months. On expiry of this period the interest rate will be either automatically changed into a variable interest rate or a fixed interest rate may be set again by agreement of the parties.

Please note that the borrower has a right to request the Bank to set a fixed interest rate for a period of up to 5 years at any time during the period of the agreement. For more information see the Rules of Estate Related Credits Granting (in Lithuanian).

The fixed interest rate is calculated on an individual basis and is set taking into account the customer‘s credit history, the purpose of a credit, the extent of cooperation with the bank, the liquidity of a real estate pledged, etc.

EBFMI is an indicator reflecting the price of a long‑term borrowing of funds on the market. It is calculated by adding a long-term financing margin (FMI) to the Euribor rate that reflects a short‑term borrowing rate.

EBFMI may vary depending on the situation in the market, i.e., changes in the FMI and Euribor; thus, it can decrease or increase.

As of January 1, 2018, FMI has been calculated by an international agency ICE Data Indices (up until January 1, 2018 – by Bloomberg).

NOTE! New loans are not issued with this interest base.

A long-term financing margin (FMI) calculation principal

EBFMI rates

The European Union Benchmark Regulation (hereinafter BMR) sets out criteria for reference rates that can be used in financial contracts going forward. Since LIBOR reference rates no longer comply with the mentioned criteria, starting from January, 2022, all non-USD LIBOR settings will cease to exist and will be replaced with the reference rates complying with requirements established in BMR.

Luminor has taken into consideration consultations and recommendations from the regulators and external working groups (brought out in Table 1 below) to ensure that the reference rates used for replacement of the ceased ones are compatible with the market practice and comparable to the existing reference rates.

Table 1. Overview of currently used interbank offered reference rates: replacement rates and timeline

|

Currency |

LIBOR reference rate |

Status in existing contracts |

Replacement rate |

Dedicated transition working group |

|---|---|---|---|---|

|

EUR |

LIBOR EUR |

Expired 2021-12-31 |

Working Group on Euro Risk-Free Rates |

|

|

CHF |

LIBOR CHF |

Expired 2021-12-31 |

The National Working Group on Swiss Franc Reference Rates (NWG) |

|

|

USD |

LIBOR USD |

Expired 2023-06-30 |

Due to the fundamental differences between LIBOR and new reference rates (as stipulated in the section above) – to make sure that all market participants are treated fairly and were not discriminated – price adjustments need to be added to the new reference rates that are used in contracts which were originally referencing LIBOR.

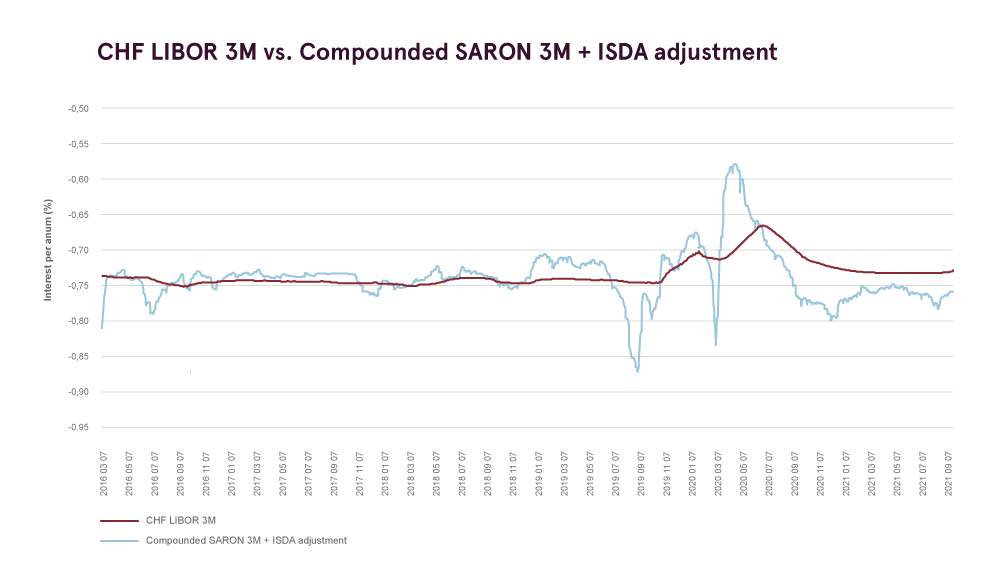

The necessity to add a fixed price adjustment to the new replacement reference rates SARON, SOFR, SONIA and €STR is further explained by International Swaps and Derivatives Association (ISDA). In July 2019 ISDA announced that Bloomberg Index Services Limited (Bloomberg) was selected as the vendor to calculate and publish this spread adjustment. Bloomberg has defined the spread adjustment calculation methodology in their “IBOR Fallback Rate Adjustments Rule Book” and published the official fixed values that should be added to the new reference rates when creating a replacement rate. Dedicated working groups (brought out in Table 1 above) have further confirmed through their consultations that adding the ISDA spread adjustment to the new reference rates (SARON, SOFR, SONIA, €STR) is the most appropriate solution. For clarity, the ISDA spread adjustments that are relevant in Luminor’s client credit agreements are brought out below in Table 2 as well.

Table 2. ISDA spread adjustments that need to be added to the new reference rates1.

|

Old reference rate |

O/N |

S/N |

1w |

1M |

2M |

3M |

6M |

12M |

|---|---|---|---|---|---|---|---|---|

|

USD LIBOR |

0,00644 % |

N/A |

0,03839 % |

0,11448 % |

0,18456 % |

0,26161 % |

0,42826 % |

0,71513 % |

|

CHF LIBOR |

N/A |

-0,0551 % |

-0,0705 % |

-0,0571 % |

-0,0231 % |

0,0031 % |

0,0741 % |

0,2048 % |

1 The ISDA spread adjustment values are not calculated by Luminor. They are produced by a third-party vendor Bloomberg Index Services Limited to facilitate fair pricing of LIBOR replacement rates. (https://assets.bbhub.io/professional/sites/10/IBOR-Fallbacks-LIBOR-Cessation_Announcement_20210305.pdf)

For example, if a 3-month LIBOR CHF was applied under the current credit agreement, it will be replaced by SARON by adding 0.0031% ISDA (see Table 2) to make the price as close as possible to the base rate of the variable interest previously applied.