More:

Economic Outlook for Baltic countries – Running of the Bulls

Economic insights Estonia: spring 2018

Economic insights Latvia: spring 2018

After a couple of sluggish years Lithuanian economy gathered pace in 2017 demonstrating robust balanced growth. Strengthening demand from the West stimulated Lithuania’s industry and exports, while low interest rates, vivid credit market, solid corporate profits, intensifying assimilation of the second wave of the EU structural funds and growing wages ensured active private and public investments and consumption of households.

External environment improved significantly last year. Expansionary monetary policies of central banks have eventually reached the real sector and fostered growth of domestic demand. Almost all Lithuania’s key exports markets improved their GDP and consumption growth rates and their appetite for imported goods and services. As a result, after a two-year break Lithuania restored double digit growth rates in both exports of goods and services.

Inflation burst out tested consumers’ appetite

Lithuania topped the rank of the EU countries according to growth rate of consumer price index. Average annual inflation in Lithuania stood at 3.7 % in 2017. Inflation was driven by several factors: imported inflation of key commodities (e.g. energy, food, etc.); growing prices of services as the surge of labour costs in this economic sector was among the highest and, finally, a significant increase in alcohol excise duty topping annual inflation rate with additional 0.7 p.p. Mounting prices in the country started ruining consumers’ appetite and spurred deceleration of real consumption growth, which slowed GDP growth in Q3. These developments sparked fears that Lithuania may enter into stagflationary phase of economic development, which would have further increased pressures on wage growth and would have weakened country’s international competitiveness. However,the most recent data suggests that inflation is running out of steam and we expect this trend to continue well into 2018. Favourable base effect, milder trends of ‘imported’ prices and smaller scale of exise tax changes let us forecast average annual inflation to reach 2.5 % this year before accelerating slightly to 2.8 % in 2018. Subdued inflation and faster real income growth of households will continues supporting domestic consumption.

Labour market bottlenecks narrow further

Lithuania’s labour market imbalances sharpened as economy accelerated. Labour market is extremely tense as demand for highly skilled labour is high. Lasting emigration reduces labour force potential and puts more strain on the job market, especially for highly skilled young people. Lithuania’s unemployment rate has decreased to 6.8 % in the fourth quarter of 2017 – the lowest level since the pre-crisis economic boom. Moreover, the twist in employment trends raises concerns. After several years of expansion the number of employed started to decrease last year in both private and public sectors. Apparently, slack in the country’s labour force has been exhausted.

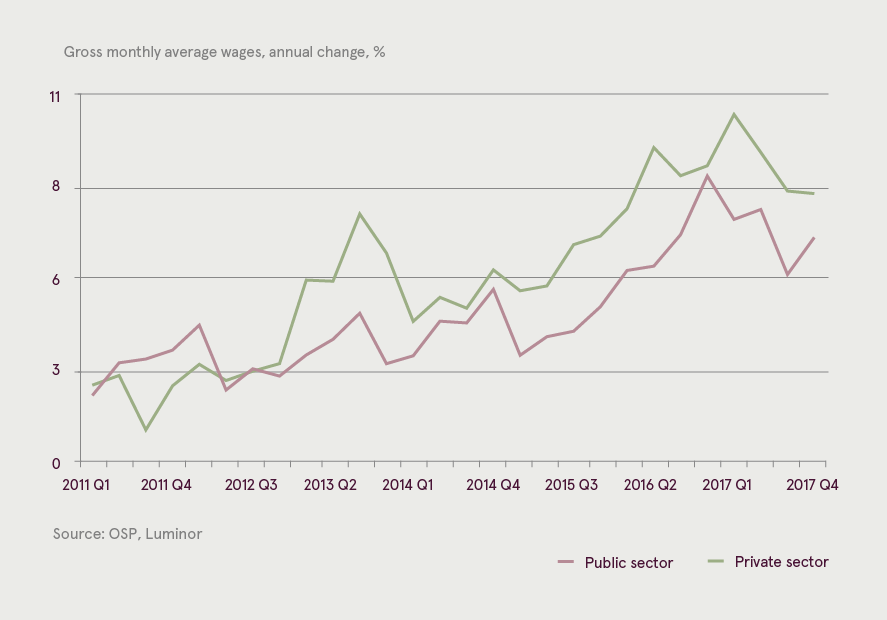

The combination of strong demand for skilled labour and tighter labour market puts an upward pressure on wages, as businesses are increasingly competing for workers by offering higher salaries. The growth of average earnings was also fuelled by political decisions to raise minimum wages and the lowest remuneration range in the public administration and other sectors of public services. As a result, average growth of gross monthly earnings peaked in Q2 last year reaching 8.7 % but is expected to moderate to more sustainable 6 % this year.

2019 is the year of both Presidential and Municipal elections in Lithuania, thus the popularity of earnings topic is programmed to increase exponentially. The minimum monthly wage question will be brought on the political scene shortly, despite the persisting debate to depoliticise it and remove from the arsenal of the politics. The wage growth will also be supported by rising public wages, as the remuneration policies in such essential public areas as education and human health activities are ripe for fundamental change. The combination of recent strikes, upcoming elections and ongoing reforms will foster more prominent and lasting break-through. Keeping all this in mind we forecast the average gross monthly wages to increase by 8 % in 2019.

Housing market reached the turning point

After a strong start of the year echoing the pre-crisis sentiments in residential real estate sector, housing market activity reached the zenith and started to fade. The seasonal weakness in summer prolonged into autumn, while winter didn’t also bring any break-though.

The number of housing transactions remained almost unchanged comparing to 2016, while market activity in Vilnius has been decreasing since 2017Q2. In the newly built housing segment it dropped by noteworthy 23 % y/y in 2017Q4. Market saturation is prominent in Vilnius, where prices of newly built flats have already reached the pre-crisis peak.

Last year we witnessed significant structural change in housing demand. Transactions for investment purposes dominated in 2014-2016. The shortage of rental housing and solid yields built an attractive investment case. These buyers often used their own funds for residential real estate purchases, thus just a third of total transactions were sealed with an involvement of a bank. However, at the beginning of 2017 rental market filled up and rents started to drop. From then on the major share of buyers in the market are households buying real estate for themselves to live and entering transaction with the banking credit support. This could be illustrated by the rally of housing loans, which started in 2016 and has been gathering momentum ever since.

The latter developments sustained market inertia and residential real estate prices in Lithuania still grew by 7.0 % y/y in 2017. However, we believe it should decelerate gradually towards 2-4 % in 2018-2019 given weakening residential real estate demand, significant number of unsold new flats on the market and optimistic housing development plans of construction companies.

Years ahead

Lithuanian economy is expected to proceed with relatively strong performance in coming years. Country’s GDP should grow by 3.3 % this year and is forecasted to decelerate slightly to 3 % in 2019-2020. Domestic consumption will remain among the key drivers as inflation is expected to ease and labour market imbalances program the persisting rapid growth of households’ income. External drivers will also remain vivid, given expected positive trends in the major exports markets. However, it will grow at a slower pace due to unfavourable base effect, Brexit contagion and possible side effects from bubbling Scandinavian real estate sector. Investment processes within the country will be fostered by more intensive assimilation of the EU funds and by the planned marked injection of foreign direct investments. Such prominent names as Continental, Hella, ROL STATGA, Hollister, AL-KO Vehicle Technology, SCHUCO, Sentiance, Booking.com have written memorandums last year and will start creating new or transfer existing business lines to Lithuania in 2018 already.

Lithuanian macroeconomic indicators

| 2015 | 2016 | 2017E | 2018F | 2019F | |

|---|---|---|---|---|---|

| Real GDP, % y/y | 2.0 | 2.3 | 3.8 | 3.3 | 3.0 |

| Real consumption expenditure of households, % y/y | 4.0 | 4.9 | 3.9 | 4.0 | 3.8 |

| Average annual inflation, % | -0.7 | 0.7 | 3.7 | 2.5 | 2.8 |

| Gross monthly wages, % y/y | 5.9 | 8.7 | 7.5 | 6.0 | 8.0 |

| Housing price index, % y/y | 3.3 | 9.5 | 7.0 | 4.0 | 2.0 |

| Unemployment rate, % | 8.9 | 7.5 | 7.1 | 6.8 | 6.5 |

| General government budget balance, % of GDP | -0.2 | 0.3 | 0.7 | 1.0 | 0.5 |

Note: E - estimate, F - forecast | Source: Eurostat, Luminor

Žygimantas Mauricas

Chief Economist

Indrė Genytė-Pikčienė

Chief Analyst

Making banking delightfully easy