Letter of Credit

How to start using it, when letter of credit is initiated by the buyer

Agree with your business partner. Agree on the conditions of cooperation with the seller.

Contact us. Issuing a letter of credit is quick and simple.

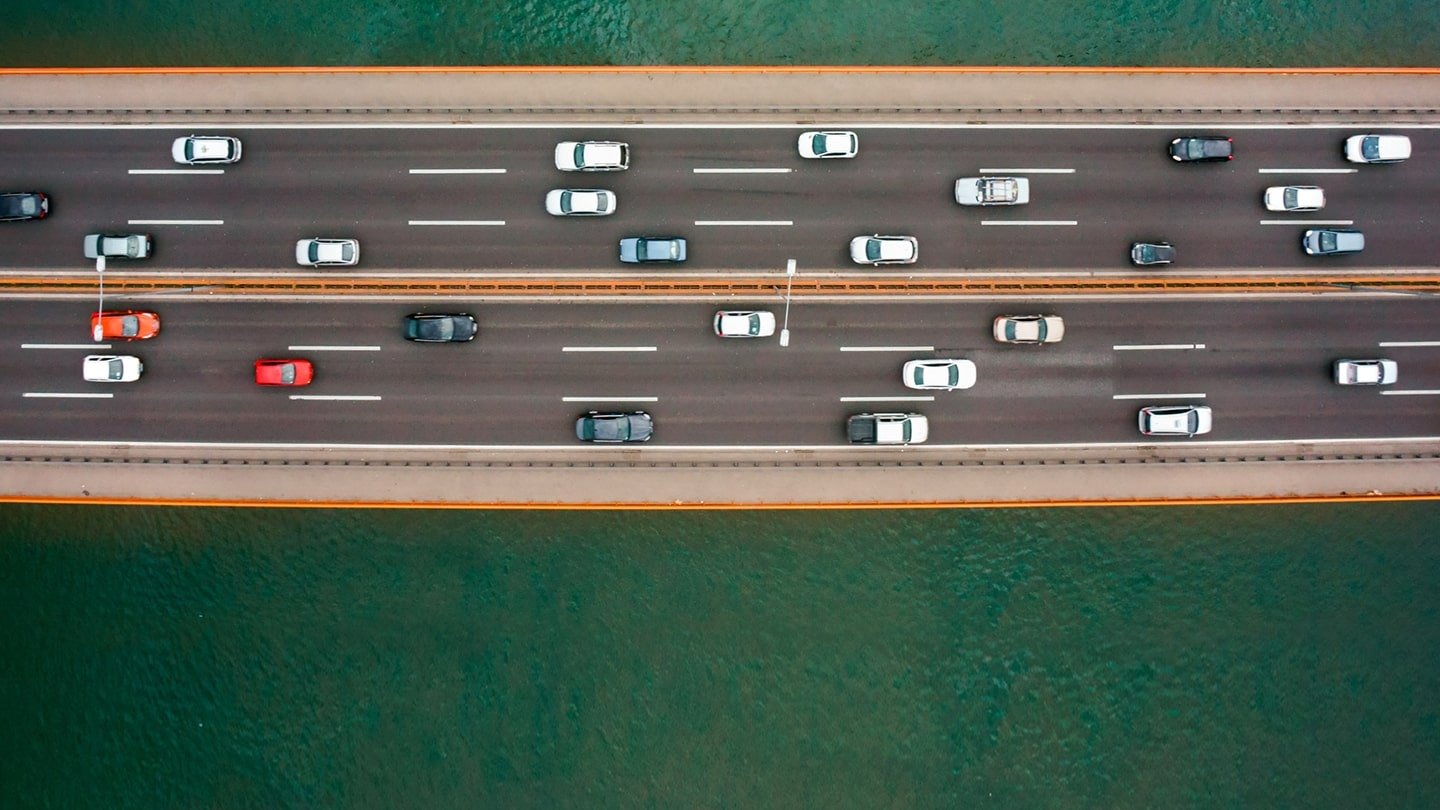

We send the letter of credit to partner’s bank. We will send the issued letter of credit to your partner’s bank, which will inform their client about it.

The seller ships the goods. Your business partner will ship the goods and will provide the agreed documents on goods to their bank.

We receive documents. Your business partner’s bank will send the documents to us.

We carry out payment for the goods. We transfer the payment to the seller and goods are delivered to you.